Regarding daily transactions, Bitcoin Runes has reclaimed the leading position on the network, surpassing the original Bitcoin, Ordinals, and BRC-20 tokens.

Launching on April 20, the Runes protocol aimed to improve the performance of BRC-20, an experimental standard for fungible tokens on the Bitcoin blockchain. This event occurred concurrently with the fourth Bitcoin halving.

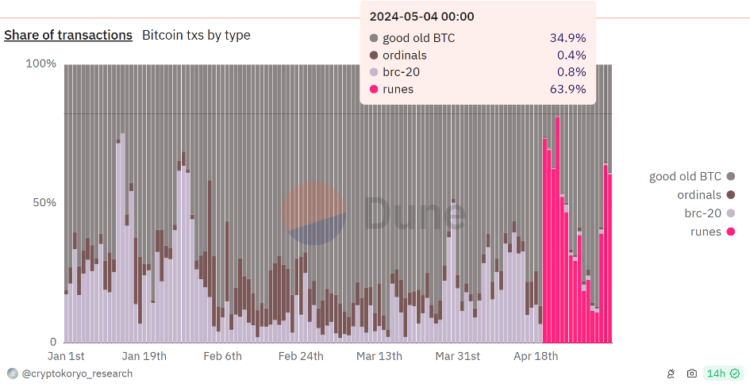

According to data from Dune Analytics, the preponderance of Bitcoin network transactions were associated with Runes until April 24.

On April 23, Runes recorded the maximum transaction share at 81.3%, resulting in a decline of the Bitcoin transaction share to 18.15%. Ordinals and BRC-20 transactions each accounted for 0.1% of the total. Nevertheless, Runes transactions steadily decreased for the following nine days, concluding on May 2.

As demonstrated previously, Runes started to recover on May 3. The following day, on May 4 and 5, Runes reclaimed a proportion of transactions over 60%.

Related: A solitary Bitcoin miner solves a valid block and wins 3.125 BTC in the lottery.

Although the surge in transaction volume unintentionally results in elevated network fees, it frequently benefits Bitcoin miners. In sixteen days, the Runes protocol accrued 2,253 BTC in fees for the mining community.

The mining community embraces an increase in fees, as their profits have decreased substantially since the halving of Bitcoin. Daily revenue for Bitcoin producers decreased to less than $30 million in May.

Miners have implemented technological advancements such as highly efficient mining machines to enhance profitability, decrease operational expenses, and optimize performance and financial gains.

Bitfarms, a Bitcoin mining company, allocated $240 million to triple its hash rate to 21 exahashes per second. Furthermore, Bitfarms has disposed of almost all of the Bitcoin it has extracted in the previous two months to reinvest in its mining fleet’s expansion.