The Securities and Exchange Commission (SEC) enforcement attorneys are reportedly conducting an investigation on Uniswap exchange and particularly seeking information about its marketing and investor services.

The Wall Street Journal reported on Friday that the US Securities and Exchange Commission has opened an investigation into Uniswap Labs, the company’s principal developer.

According to the report, enforcement attorneys are now investigating Uniswap’s marketing and investor services, citing anonymous persons acquainted with the situation.

Uniswap Labs is apparently “committed to complying with the laws and regulations regulating our sector and to giving information to regulators that will assist them with any inquiry,” according to a spokesman.

Uniswap is a decentralized exchange that allows users to exchange Ethereum-based coins and tokens without the need for a central authority.

According to CoinMarketCap data, the exchange is the largest decentralized exchange, with a $1.5 million trading volume over the last 24 hours at the time of writing.

The news comes as US regulators pay more attention to the decentralized finance (DeFi) industry, with SEC chairman Gary Gensler declaring last month that the agency wants to issue more crypto-related rules aimed at DeFi, token offerings, and stablecoins.

The regulator agreed to a $125,000 arrangement with blockchain analytics firm AnChain.AI in late August in order to receive technical support in monitoring and regulating the DeFi market.

Uniswap delisted dozens of tokens and tokenized stocks from its trading platform in late July, claiming heightened regulatory pressure, prior to the SEC’s increased attempts to probe into the DeFi.

“We keep an eye on the changing regulatory landscape,” Uniswap stated, citing other DeFi participants that have taken similar steps.

The ‘DeFi Space’

The DeFi industry, by definition, is a blockchain-based form of finance that operates transactions through autonomous protocol mechanisms known as smart contracts rather than relying on central financial intermediaries.

The sector has grown dramatically in recent years, from a total worth of roughly $8 billion last September to more than $174 billion at the time of writing.

Decentralized exchanges (DEX) like Uniswap, which follow DeFi principles, do not have a central person or team in charge of administering the protocol; instead, it is administered and supervised either automatically or by the participants.

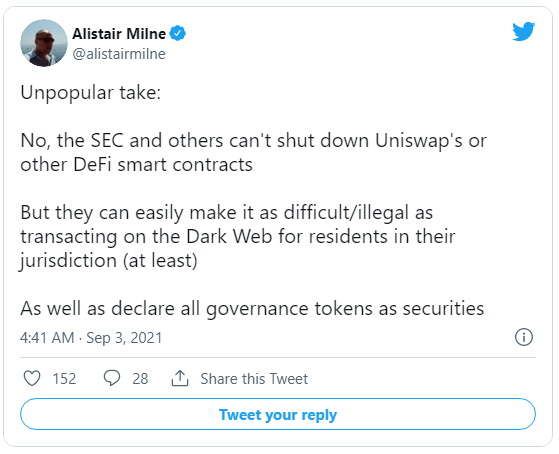

According to Alistair Milne, a crypto investor and entrepreneur, regulators will not be able to shut down DeFi smart contracts like Uniswap, but they may be able to declare DeFi transactions unlawful, comparable to dark web transactions.