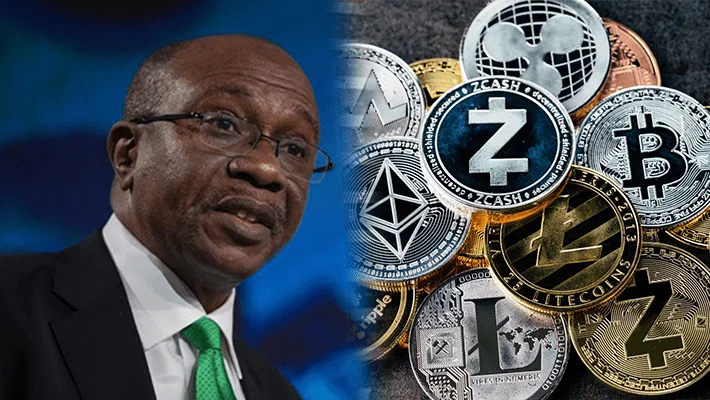

The SEC says it works with the Nigerian Central Bank to better understand and regulate cryptocurrencies.

At the first virtual news conference of 2021, the General Manager, Lamido Yuguda, said that.

Mr. Yuguda said SEC has been talking with the CBN to better understand the cryptoasset market and to regulate that.

He said that due to a lack of access to Nigerian bank accounts, the commission has stopped implementing crypto-assets guidelines.

“We are talking with CBN to better understand and regulate this market. We can come back later to tell you the results of the undertakings.”

“However, by September 2020, because of lack of access to commercial bank accounts, we had to suspend our own guidelines. This circular shall be suspended until such operators have access to Nigerian bank accounts,” he said.

Further, he said: “Remember, if that person does not have access to a Nigerian bank account, no-one will operate on the Nigerian capital market.”

However, Mr. Yuguda stated that the SEC was still supportive of Fintechnology and had invested so much in developing an operational framework.

“Let me say that the SEC is still strongly supporting Fintech.”

“In the field of crowdfunding, investment advice and other like issues we have invested heavily in the developing of a Fintech framework in different fields.” he said.

He said CBN’s ban on Nigerian bank accounts through crypto exchange was disrupting the markets.

“Nothing has changed in all other areas, but in the area of cryptoactive assets, you know that this market has disrupted with the recent CBN prohibition on access by cryptoaccounts to Nigerian bank accounts.

“The truth, while the SEC issued in September 2020 guidance aiming to regulate this market, is that these exchanges have no market access to commercial bank accounts in Nigeria for the time being,” he said.

The commission acknowledges, according to him, the impact on capital market activities of FinTechs. He assured the public that SEC would continue to take this development into account.

“We shall continue to engage and support players in their legal operation.

“Without stifling innovation, our objective is to ensure the delivery of safe products and services,” said Mr Youguda.

He encouraged Fintech companies to approach the commission for proper registration and refrain from illegal operations.