The price of a Serum token went as high as 32 cents, up from a low of 12 cents just two days ago. This happened as members of the decentralized exchange scrambled to implement an emergency fork after the hack of Sam Bankman-FTX Fried’s exchange raised security concerns.

The serum is a decentralized exchange protocol on the Solana blockchain. On Tuesday, the value of its SRM tokens shot up on digital asset markets as key backers of the project rallied around an emergency fork in response to the recent hack of Sam Bankman-failing Fried’s FTX exchange.

After warnings that security may have been broken by the Nov. 11 hack, the project’s community “forked” it, which is blockchain-speak for “copied the project’s software code and started over.”

The alarms caused the price of SRM to drop, making it one of the crypto markets’ biggest losers. The coin became one of the biggest winners overnight because of the bounce.

The price of serum (SRM) started going up around 23:30 UTC on Monday. On Tuesday, it reached 32 cents, up from 12 cents on Sunday, when it was at its lowest. At the time of press, the token had gone back to being worth 29 cents. It’s still 95% less than it was a year ago.

Jupiter Aggregator, a key liquidity aggregator for Solana DeFi that connects to Serum, tweeted on Tuesday that it was already testing the integration of the new version and “will announce it as soon as it’s ready.”

The price increase was probably caused by the community “rallying behind a fork,” but it’s “not clear how the SRM token would do if the fork gains traction,” Riyad Carey, an analyst at the crypto analysis firm Kaiko Research, told CoinDesk.

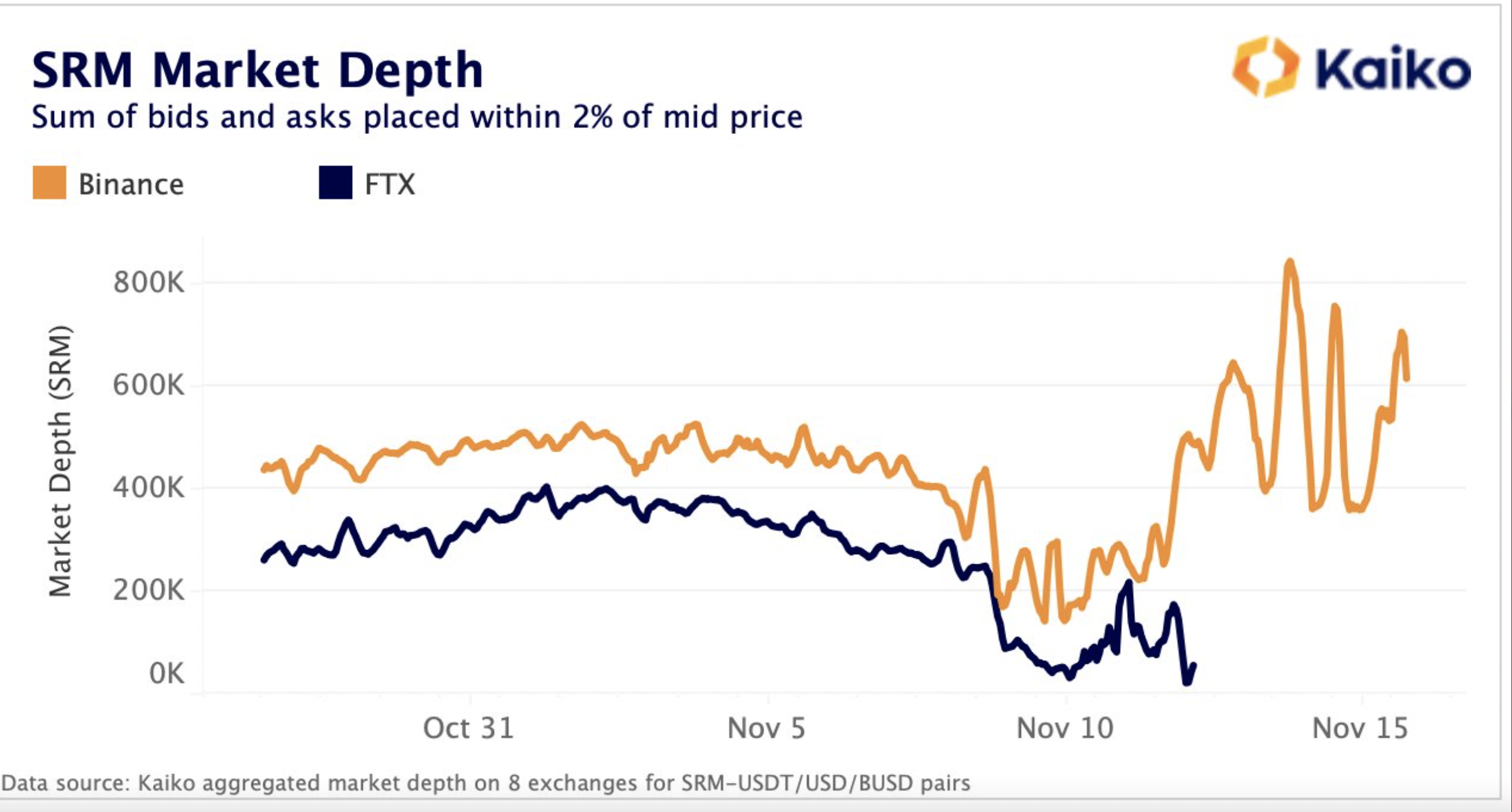

In a research report released on Monday, Kaiko said that the collapse of Bankman-crypto Fried’s empire, which included the FTX exchange and trading firm Alameda Research, caused a sharp drop in the market depth of SRM tokens on crypto exchanges last week.

This seemed to change on Tuesday. According to Clara Medalie, director of research at Kaiko, the total number of SRM tokens on the Serum order book shows that SRM’s liquidity on Binance is now higher than it was before the crash.

Medalie told CoinDesk that “support for SRM on Binance has been building up since the crash.”

She said, “Market makers are moving money to Binance to keep the price up.” “On almost every other exchange, liquidity dried up.”

Anatoly Yakovenko, a co-founder of Solana, tweeted on November 12 that developers who depended on Serum had split off the program because “the upgrade key to the current one has been stolen.” He said that “a lot of protocols need liquidity and liquidations from Serum markets.”

Brian Long, a well-known validator, said in a tweet that the effort to replace Serum with an open-source version run by the community has sparked renewed interest in the market.

The fallout from FTX-Alameda last week has brought the Solana community to its breaking point. The Solana Foundation said on Monday that it had 134.54 million SRM tokens and 3.43 million FTT tokens on FTX when withdrawals stopped on November 6.

Nearly $700 million worth of Solana-based applications has also been wiped out. This is a 70% drop from the $1 billion in total value locked (TVL) on Nov. 2, when CoinDesk first reported on Alameda’s troubled balance sheet.

Solana’s native token, SOL, had a small gain on Tuesday, going up 6% to about $14. The rise was 2% for the CoinDesk Market Index.

Medalie said that a sudden rise in the price of SRM might not be a good sign of how prices will move in the future because “Alameda still left a big gap.”