Maple Finance, an institutional crypto lender, has expanded its blockchain footprint by debuting the Solana blockchain.

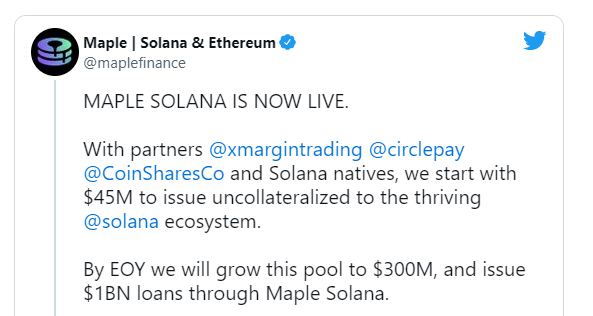

Maple Finance, a decentralized marketplace for institutional lending, has officially started on the Solana blockchain platform. Maple, in collaboration with its partners, will launch a $45 million fund to help build the Solana ecosystem in the short term.

Maple Finance becomes a multi-chain institution

A number of pool delegates provide undercollateralized loans for institutional borrowers on Ethereum (ETH) and now Solana (SOL) to Maple, which is a cryptocurrency exchange. According to a blog post published on April 25, the initiative has already “originated over $1.2 billion in loans and now counts over $900 million in TVL to the platform.”

With funds contributed by USD Coin (USDC) issuer Circle, digital asset management CoinShares, and many undisclosed Solana-based companies, the ecosystem fund was formed in collaboration with decentralized finance (DeFi) lending platform X-Margin.

Crypto-native businesses can use Maple Finance’s uncollateralized loans to improve their operations in a capital-efficient way that would otherwise be challenging. The crypto-focused venture firm Framework, as well as the Sam Bankman-backed trading outfit Alameda Research, are among the first borrowers on Maple Solana.

Maple is a hybrid of decentralized and centralized finance that uses human actors to assess the creditworthiness of potential borrowers. Before getting approved for a loan, prospective borrowers must go through a thorough due diligence procedure.

On Maple Solana, the first pool delegate to accomplish this is X-Margin, which is responsible for credit scoring as well as issuing, underwriting, and handling interest and payments for institutional loans. It will actively manage these activities using Maple’s infrastructure.

The Maple Solana pool now holds approximately $34 million in Circle’s USDC stablecoin and is close to reaching its original capacity. Maple has contributed roughly $900 million in liquidity to the Ethereum ecosystem and has created around $1.2 billion in loans since its start nearly a year ago.

Maple’s onboarding of Celsius, which brought $30 million in wrapped Ethereum that institutions might possibly borrow, further expanded its services into the area of centralized financial lenders in February.

All borrowers must undertake know-your-customer and anti-money laundering checks to enable institutions to retain confidence that they may utilize Maple in a way that is consistent with the legislation.

In the next three to six months, the Maple Solana team aims to deploy its SYRUP governance token, which will be comparable to the MPL token for Maple Ethereum. Furthermore, a Maple spokesperson told Crypto Briefing that following X-Margin, the next loan assessor will be “an established b2b crypto lender, brokerage, custody, and trading business.”