The price analysis for Solana (SOL) suggest that the stock could reach $275 in the coming sessions.

The bullish outlook for Bitcoin, the world’s sixth-largest cryptocurrency by market capitalization, comes as the cryptocurrency consolidates within a range that resembles a Bull Pennant pattern.

To put it another way, Bull Pennants are bullish continuation indicators that form when the price consolidates within a Symmetrical Triangle-like structure following a significant upward move.

The consolidation trend is accompanied by declining volumes, which reflects the underlying weakness of the consolidation trend.

In addition, as the price nears the apex—the point at which the Pennant’s trendlines converge—it is more likely to experience a breakout to the upside, with the bull target at a length equal to the previous uptrend’s height, i.e., the Flagpole.

The height of the flagpole in Solana is approximately $125. Having said that, a breakout move at the Pennant’s apex (at around $150) would put SOL on track for a $275 reversal.

Despite Bitcoin’s current price of $60,000, the SOL/BTC pair is up

Solana’s chances of reaching $275 come amid a general price increase across the cryptocurrency market.

However, the price of SOL has increased by 8 percent in the past two days when compared to the price of Bitcoin (BTC), in part as a result of its listing on South Korea’s largest cryptocurrency exchange, Upbit.

Overall, SOL has been one of the best-performing altcoins in 2021, with profits of 8,500 percent year-to-date and a market capitalization of $1 billion. In early September, SOL reached a new all-time high of $216 per share.

The price of SOL is being boosted by institutional inflows

Even though Bitcoin is currently in the spotlight, according to a report published earlier this week by CoinShares, Solana’s price has likely received a boost from institutional capital in the form of dedicated investment funds, which has helped to drive up the price.

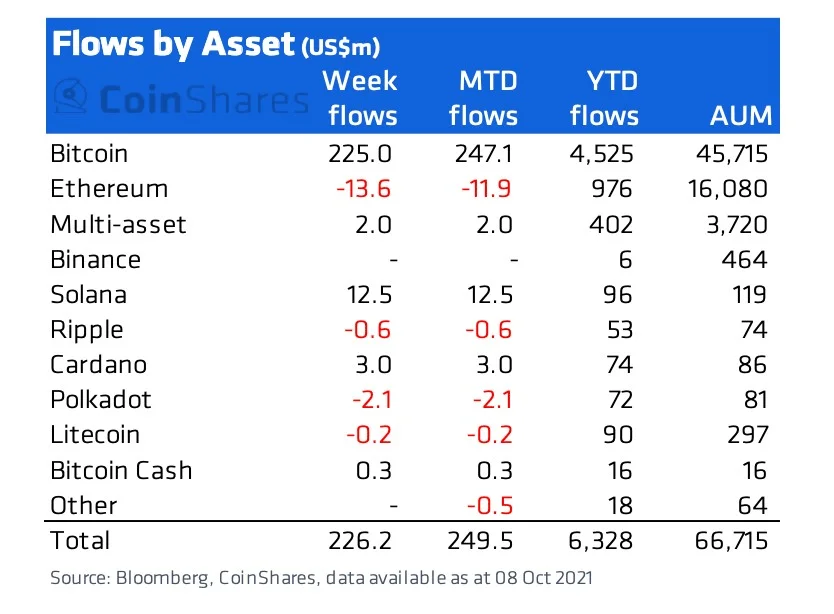

According to CoinShares, “digital asset investment products saw inflows totaling US$226 million, bringing the 8-week run of inflows to US$638 million,” with the company noting that “500 totaling US$226 million” was seen.

“It was a mixed picture in other altcoins with recent favorites Solana (US$12.5 million) and Cardano (US$3 million) continuing to see inflows, suggesting the focus hasn’t entirely switched to Bitcoin.

Unless otherwise stated, the views and opinions expressed here are solely those of the author and do not necessarily reflect the views of coinscreed.com or its subsidiaries. Risk exists in every investment and trading decision; therefore, before making a decision, you should conduct your own research.