Solv Protocol has launched SolvBTC, a Bitcoin staking token on Solana, to attract holders amid growing yield opportunities.

In an attempt to attract Bitcoin holders at a time when yield chances for the digital currency are increasing, Solv Protocol introduced a Bitcoin staking token on Solana.

Projects on other networks, like Ethereum and Solana, are being forced to compete for Bitcoin liquidity as a result of the introduction of new Bitcoin yield possibilities inside the expanding ecosystem of layer-2 scaling chains (L2s) and decentralized finance (DeFi) protocols that are contained within the Bitcoin network.

One of Solana’s most prominent decentralized exchanges (DEX) is Jupiter Exchange. Jupiter Exchange’s liquid staking derivative (LSD), known as JUP, aims to generate a dividend in Bitcoin (BTC) from the transaction fees it collects.

According to Solv, the debut of the token is still in the experimental phase, but it is a part of a continuing effort to expand Bitcoin’s position in decentralized banking. When compared to Bitcoin staking on L2s, which typically pay annual percentage returns (APRs) in the low single digits, Solv is aiming for a yield of roughly 12% on Bitcoin.

This is a significant increase from the current yield of 12%. By hedging against variable token price exposures in Jupiter’s liquidity pool, the greater return neutralizes the increased risks that are associated with the hedging”.

Solv reduces risk by implementing a delta-neutral strategy,” Solv explained. “This strategy involves hedging the traders’ net open interest on centralized exchanges,” Solv added.

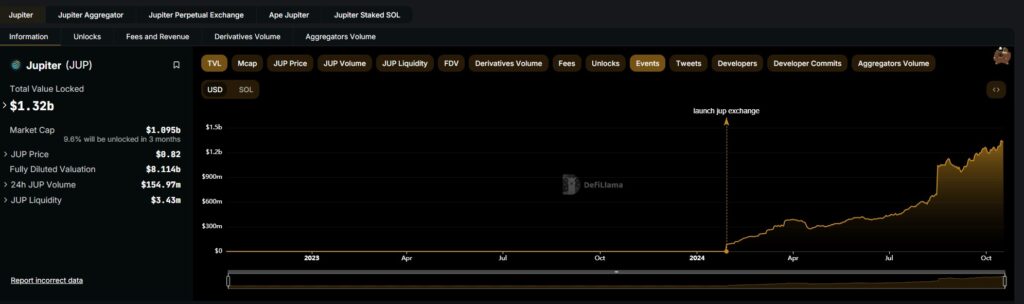

According to DefiLlama, Jupiter is about $1.3 billion in total value locked (TVL), making it one of the most active decentralized exchanges on the Solana platform. A few of the L2s that are native to Bitcoin, such as Core Chain, Babylon, and Spiderchain, are investigating the possibility of staking Bitcoin natively.

Similarly to proof-of-stake (PoS) networks like Ethereum, Bitcoin L2 stakers use Bitcoin as collateral to safeguard the networks in exchange for incentives. They take this action to safeguard the networks’ integrity.

The largest restaking protocol on Ethereum, EigenLayer, has also made an effort to attract Bitcoin holders by including wrapped Bitcoin on the list of assets that EigenLayer accepts as collateral for restaking transactions.

Restaking is the process of using a token that has already been staked, which means that it has been posted as collateral with a validator in exchange for incentives, and then having that token be used to secure other protocols at the same time.