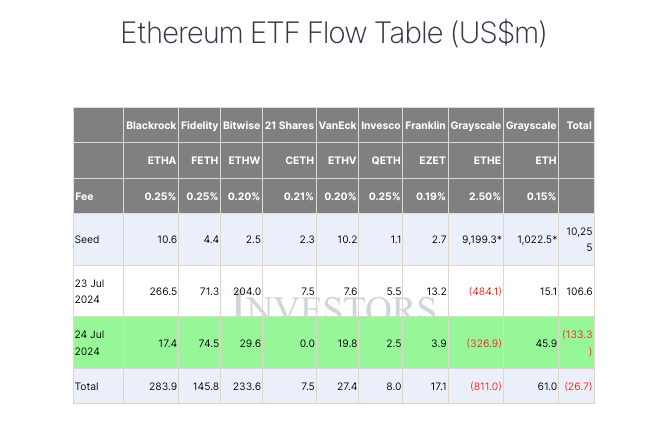

On their second trading day, Grayscale’s Ethereum Trust was the primary cause of the $113.3 million net outflows experienced by US-based spot Ether exchange-traded funds (ETFs).

On the second day of trading, seven of the eight “newborn” spot Ether ETFs experienced net inflows. The Bitwise Ethereum ETF (BITW) and the Fidelity Ethereum Fund (FETH) were the top net inflows, with $74.5 million and $29.6 million, respectively.

On July 24, BlackRock’s iShares Ethereum Trust (ETHA), which experienced the most sustained inflows among the group on July 23, only collected $17.4 million from investors.

On day two of trading, ether exchange-traded funds (ETFs) experienced net negative outflows. Source: FarSide Investors

The outflows of $326.9 million from the recently converted Grayscale Ethereum Trust (ETHE) weighed down the new ETFs.

Grayscale first introduced ETHE in 2017, which enabled institutional investors to acquire ETH. Nevertheless, it implemented a six-month lock-up period for all investments. Upon its conversion to a spot Ether fund on July 22, investors could more easily sell their ETH.

ETHE has experienced $811 million in outflows in the two days following its conversion, indicating that existing ETHE investors have sold off just over 9% of the fund’s holdings.

The performance of the Ether ETF in the recent period is not unprecedented.

The Grayscale Bitcoin Trust ETF was the source of outflows for many Spot Bitcoin ETFs, which experienced cumulative net outflows on six of their first ten trading days.

At the time of publication, ETH is trading at $3,172, a decrease of over 6.8% in the past 24 hours and 7.4% over the past week, according to TradingView data.

The price action of Ether deteriorated in conjunction with a broader sell-off in the equities market, resulting in the S&P 500 closing down 2.3% on July 24.

ETH experienced a more severe decline than Bitcoin, which experienced a mere 2.6% decline. This is consistent with the prediction of Kaiko analyst Will Cai that the price of ETH could be highly “sensitive” to inflows in the wake of the ETFs’ introduction.

On its inaugural day of trading as a spot Ether ETF, Grayscale’s ETHE experienced a $484.4 million decline. Nevertheless, the cumulative net inflows reached $106.6 million due to the robust inflows across the other eight products.