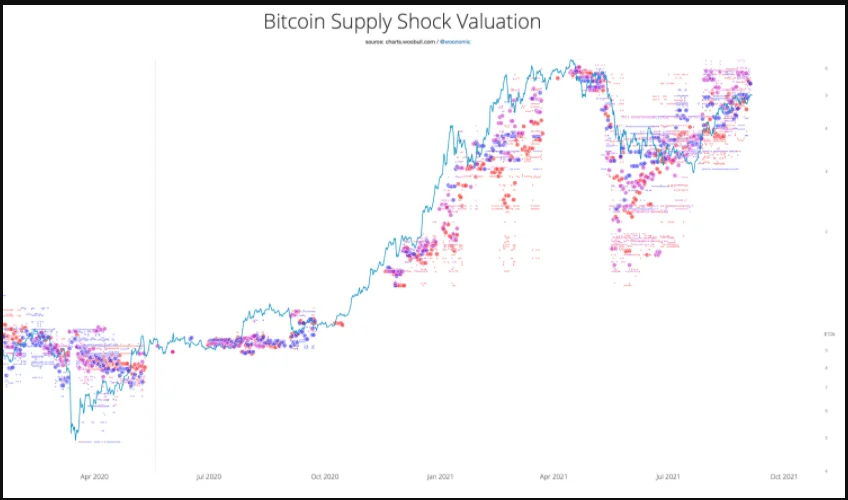

According to one criterion used to measure Bitcoin’s so-called “supply shock,” each coin should be worth at least $55,000.

Willy Woo, a cryptocurrency analyst, highlighted what he described as a “conservative” pricing prediction for bitcoin to US dollar in a tweet on September 5.

As measures catch up with bitcoin, the price of bitcoin falls.

While Bitcoin has yet to establish a stable support level of $50,000, on-chain measures have been significantly more optimistic for quite some time.

Now, the so-called “supply shock valuation model” has joined them, predicting a price of $55,000, which is considered conservative by the industry.

Supply shock is just the difference between the unavailable BTC supply and the available BTC supply divided by the unavailable BTC demand. Although this appears to be a simple technique, Woo employs it to effectively “wave a magic wand and gauge the intent of investors before any bids or offers are even placed.”

He stated in a blog post last month that under this view of demand and supply, an investor who has no intention of selling is on the demand side, but an investor who is prepared to sell is on the supply side.

Additional to that, an algorithm is used to compare similar supply and demand conditions to the current situation, resulting in the generation of an accurate estimate of fair price.

It is conservative because one of the SS metrics, exchange SS, is currently above all-time high levels, making it impossible to go backwards. This is a reference to the record numbers of coins in cold storage compared to coins traded on exchanges, which Woo recognized in a subsequent tweet.

BTC’s price fluctuated both with and without changes in investor sentiment, as depicted in the accompanying chart.

Bulls must clear a $50,000 initial hurdle

The phrase “Bitcoin supply shock” is frequently heard in the present market, owing to the fact that 2021 will be the year following a block subsidy halving event.

With miners now unlocking only 6.25 BTC every block, Bitcoin has so far behaved in a manner that is remarkably similar to prior post-halving years — 2013, 2016, and 2017.

The conservative minimum objective of $55,000 is nevertheless higher than another set of monthly closing minimums from analyst PlanB, who predicts that September will have a minimum monthly close of $43,000 in the stock market.

Following that, however, the upward trend resumes in earnest, with Bitcoin ending 2021 with a value of at least $135,000.

During the time of writing, the Bitcoin/USD exchange rate was trading at $50,200, having maintained a tight range throughout the weekend.