Although Terra Classic rejects the proposal for a community website, the price of LUNC has increased by 5% in response to positive developments in Terraform Labs’ bankruptcy proceedings.

A proposition to establish an independent community website has been overwhelmingly rejected by the Terra Classic community, which has sparked market discussions. Nevertheless, Terra Classic’s LUNC token experienced a substantial increase, surpassing 5%, despite this setback. The recent positive developments regarding Terraform Labs (TFL) and its Chapter 11 bankruptcy proceedings likely caused this surge.

Key Proposal Rejected by Terra Classic Community

The Terra Classic community recently voted on a governance proposition to create an independent website modeled after Bitcoin.org. The objective of this proposed independent website was to cultivate a more cohesive community by integrating design processes and concept workshops.

Nevertheless, the Terra community’s proposal was met with only a tiny amount of support. Only 4% of the ballots were in favor, while more than 21% were against it. The proposal was vetoed by a substantial 63% of the participants, while 12% opted to abstain.

In the interim, the Terra Classic community’s hesitation to pursue this course of action is evidenced by the rejection of this proposal. However, the price of Terra Classic (LUNC) experienced a remarkable rally despite the proposal’s failure. The token’s approximately 5% increase in value demonstrated the Terra ecosystem’s resilience, which attracted market attention.

Is Price Increase Due to TFL Bankruptcy Update?

The recent increase in LUNC can be attributed to the latest information regarding Terraform Labs’ Chapter 11 bankruptcy proceedings. As previously reported by CoinGape Media, a new court order has authorized the reopening of the shuttle bridge and a substantial 150 million LUNA fire. This development has increased optimism and interest in the Terra Classic community.

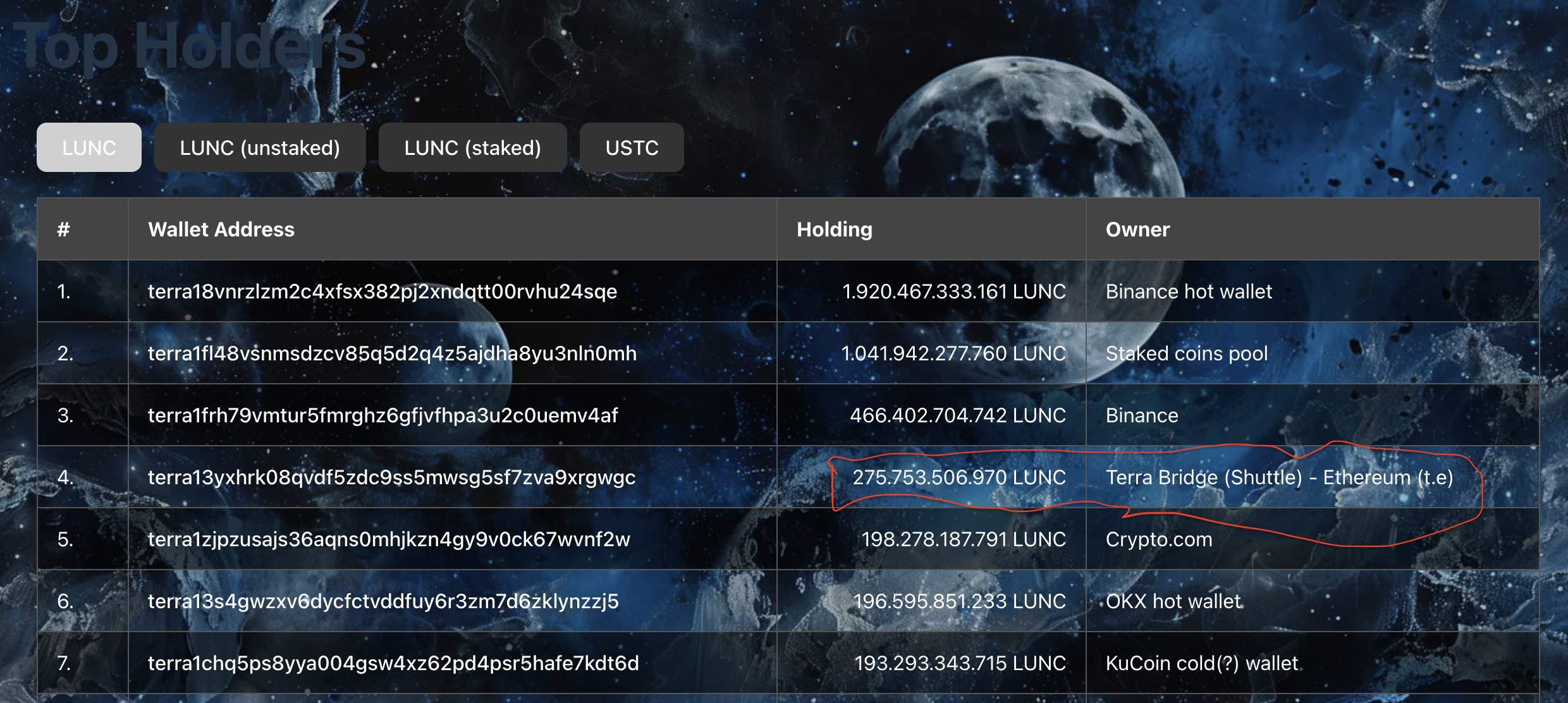

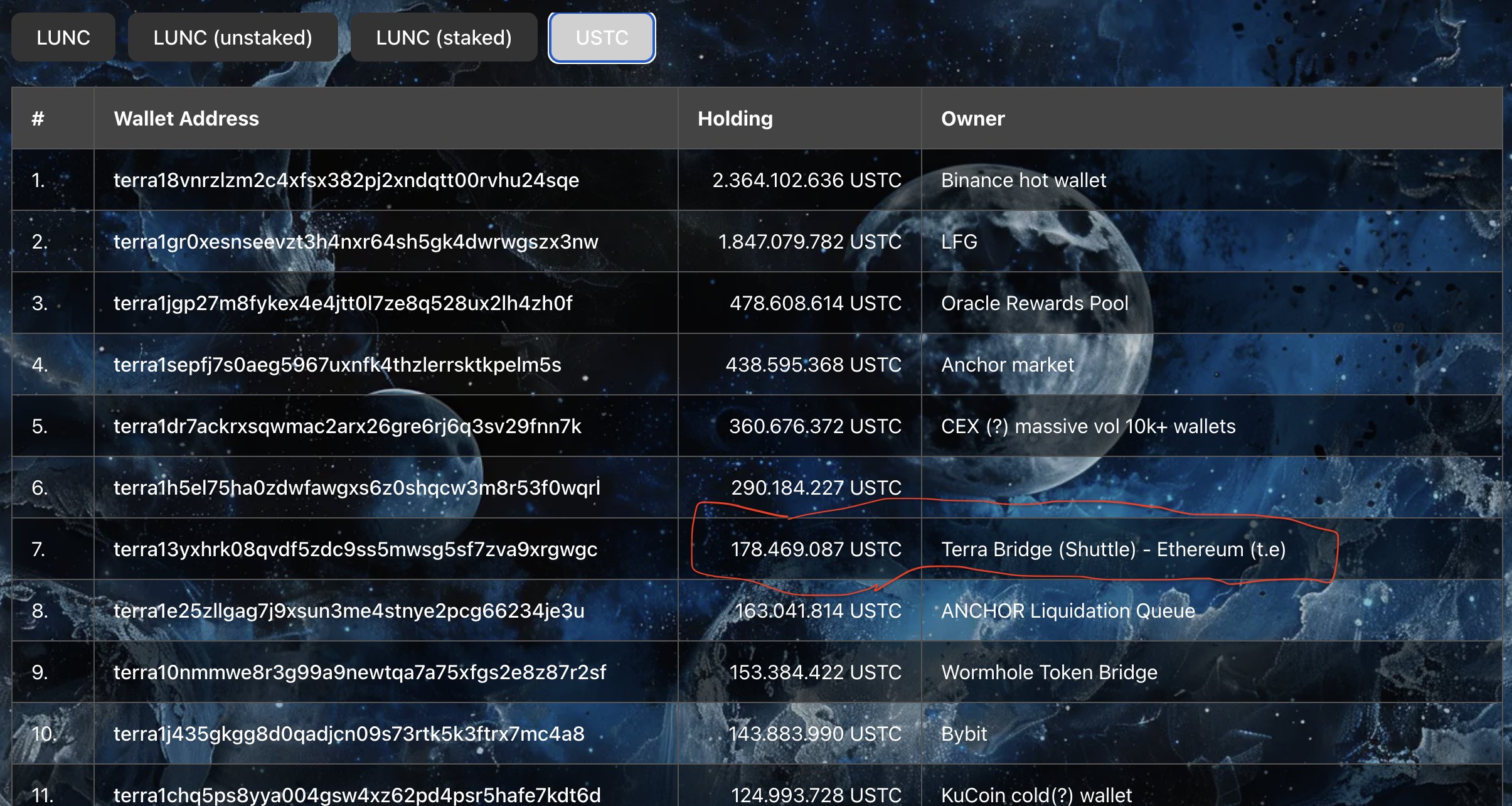

In the interim, the Terra community underscored the significance of these revisions. The shuttle bridge’s reopening enables the transportation of substantial quantities of USTC and LUNC.

According to the data, the bridge comprises 178.4 million USTC and 275.7 billion LUNC. Notably, the Terra Classic community intends to maintain the bridge’s operational status for one month. The circulating supply will be diminished if the funds are not withdrawn during this period, as they will be incinerated.

This strategic maneuver aims to enhance market confidence and ensure the long-term stability of the Terra ecosystem. Furthermore, additional purses are anticipated to be burned, with comprehensive information to be provided by September 2024. This systematic approach to token supply management has been well-received by both the community and investors.

At the time of this writing, the price of LUNC was $0.00009108, with a 4.65% increase and a 24-hour high of $0.00009153. The token registered a nearly 30% increase in the past seven days, indicative of the increasing market interest.

Conversely, the price of USTC increased by approximately 4% to $0.02047. Additionally, its one-day trading volume increased by approximately 60%, suggesting substantial trading activity.