Terraform Labs wants to subpoena bankrupt FTX for relevant documents it could use to defend its case against the U.S. SEC.

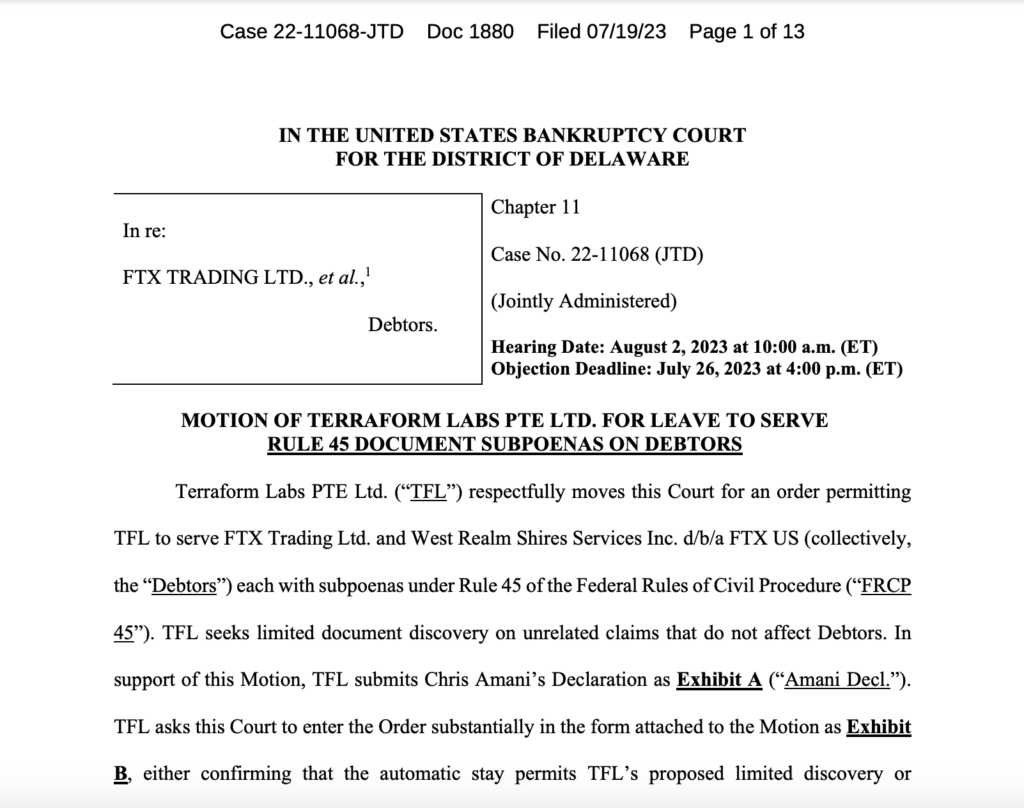

According to a court document, Terraform Labs requests authorization from the judge to subpoena data from the insolvent cryptocurrency exchange FTX, arguing that the information could aid in its defense against a lawsuit filed by the U.S. Securities and Exchange Commission (SEC) in February.

On July 19, Terraform’s attorneys filed a motion in the bankruptcy case of FTX seeking access to the company’s records regarding the digital wallets used by short sellers between March 2022 and May 2022 to gather information that would support their defense against fraud allegations.

According to the firm, the failure of Terraform’s stablecoin was caused by a coordinated effort by short sellers, presumably including Alameda Research, FTX’s sister company.

“To establish these defenses, TFL needs Debtors’ records about wallets, accounts, and assets used to transact on the FTX International and U.S. exchanges and sales/offers of large volumes of cryptocurrencies developed by TFL, if any, by FTX Trading and West Realm Shires Services Inc. d/b/a FTX US.”

Do Kwon, the founder of Terraform Labs, and the company were named defendants in a lawsuit brought by the SEC on February 16 for allegedly “orchestrating a multi-billion dollar crypto asset securities fraud.”

The regulator claimed that Terraform was operating using its abandoned algorithmic stablecoin TerraUSD (UST) and the Terra Luna (LUNA) token to market unregistered securities. The collapse of Terraform in 2022 cost the cryptocurrency markets more than $40 billion.

The SEC charged Jump Trading, which it claimed worked with Terraform to manipulate the price of the UST stablecoin, with working along with Terraform to manipulate wallet information.

Similar claims against Jump Trading have been made in Illinois for allegedly buying millions of UST tokens in 2021 as part of a deal with Terraform to reinstate the stablecoin peg to $1.

“Defendants misrepresented UST’s recovery by claiming that the algorithm was able to restore and maintain the price peg. According to the SEC, UST instead recovered its price peg because Defendants entered an arrangement with a U.S. trading firm, Jump Trading, […] to purchase substantial amounts of UST to support the price,” reads the court filing.

Terraform is also attempting to dismiss a California class action case, claiming that because of its Singaporean location, the relevant U.S. securities laws do not apply to its foreign-developed procedures.