Terra, the second-largest Defi blockchain, saw its total value locked (TVL) hit a new high on Tuesday amid a rising number of deposits.

Defi Llama data showed that TVL on the Terra blockchain increased by roughly 5% to a new high of $21.8 billion. The blockchain is now behind only Ethereum in terms of TVL, although the gap is astronomical ETH’s TVL is $81.6 billion.

The two major Defi liquidity platforms on Terra, Lido and Anchor Protocol, had the biggest increases in TVL, about 8%, and 10%, respectively. Anchor also maintains its dominance in Terra’s Defi market, accounting for 76% of TVL.

Terra’s native token, LUNA, increased in tandem with the blockchain’s TVL.

Terra’s increasing Defi value good for LUNA

Given that a bulk of engagement with Terra’s platform occurs through its native token, LUNA tends to profit from the increased activity. In the past 24 hours, the token has gained 8.5% and is trading at $96.46.

The recent gains also helped LUNA surpass Ripple (XRP) to become the seventh-largest cryptocurrency at a $33.5 billion market capitalization The token saw outsized trade volumes of $2.5 billion in the last 24 hours.

Because the majority of TVL inflows were concentrated towards Anchor Protocol, the platform’s governance token, ANC, also increased by 9%. Anchor presently has one of the highest deposit yields in the Defi space, at 20%. The platform’s high yields are a major driver of inflows to it.

Trading volumes for its stablecoin, UST, have increased as a result of increased engagement with Terra’s Defi platform. The total amount of USTs in circulation is now above $18 billion.

Concerns over sustainability

While Terra’s Defi interest has grown in recent weeks, there is still concern about its sustainability.

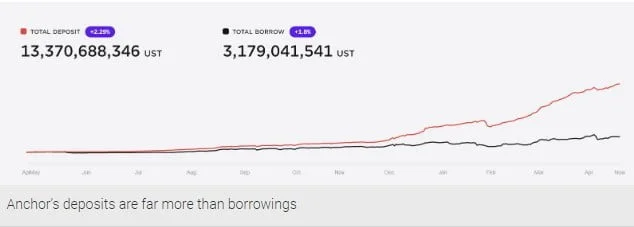

Anchor, for an instance, has a disproportionately high number of depositors compared to borrowers, which means that paying a 20% yield on all deposits will eventually deplete the platform’s reserve.

While the community has taken steps against this by implementing a dynamic yield, the number of depositors continues to grow at a staggering rate. This could also eventually drive yield to market-average levels, making Anchor less appealing to investors. The platform is also very exposed to liquidity shocks because of its outsized volume of deposits.

Despite this, Terra founder Do Kwon has been consistently increasing UST reserves to avoid a situation like this. Kwon plans to back UST with $10 billion in Bitcoin.