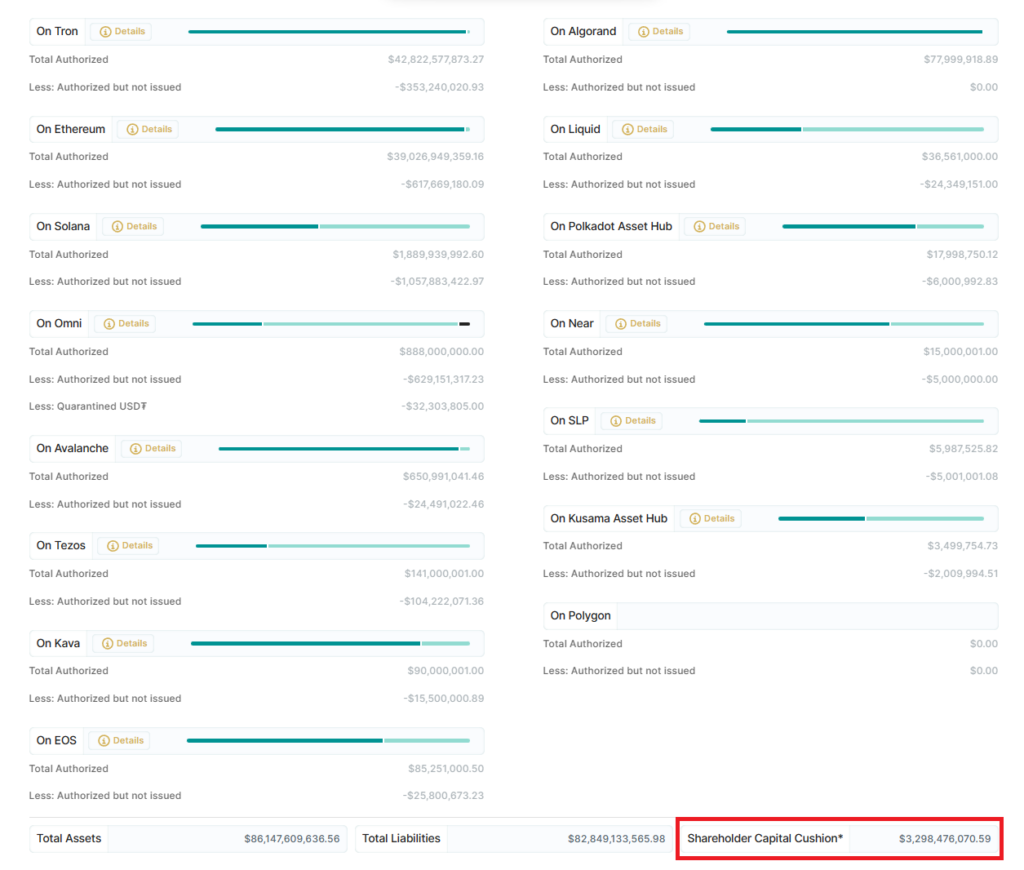

Total Tether assets are $86.1 billion, while total liabilities are $82.8 billion, indicating a reserve underpinning of over 100 percent.

Tether, the issuer of stablecoins, maintains a liquidity cushion of nearly $3.3 billion to stabilize the Tether ecosystem and inspire investor confidence.

The Tether reserves report as of August 24 reveals a total shareholder capital cushion surplus of $3.29 billion, distributed across 15 blockchain ecosystems. In addition to Algorand and Polygon, Tether reserves the right to issue USDT USDT.

Regarding pre-authorized issuance value, the Solana ecosystem leads the pack with $1.57 billion, followed by Ethereum and Tron with $617 million and $352 million, respectively.

Total Tether assets are $86.1 billion, while total liabilities are $82.8 billion, indicating a reserve underpinning of over 100 percent.

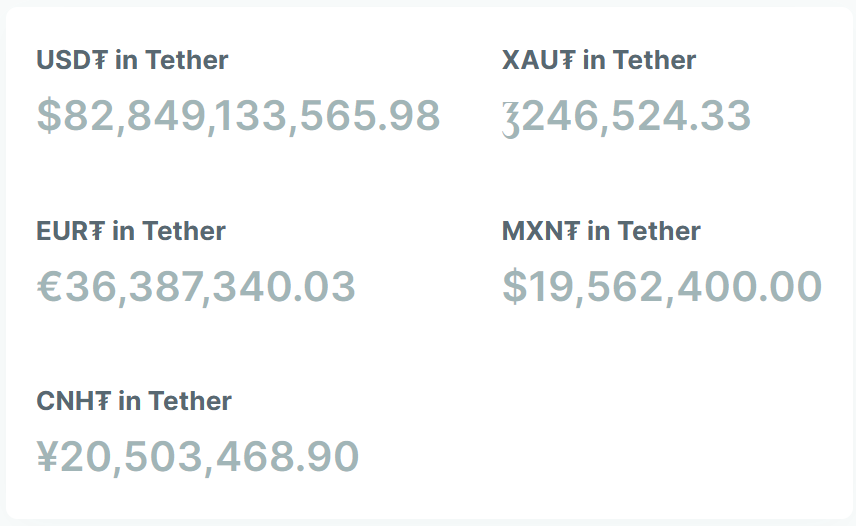

The other stablecoins issued by Tether that are not pegged to the US dollar, XAUT, EURT, MXNT, and CNHT, do not enjoy the same liquidity cushion as USDT. According to the report, none of the other stablecoins issued by Tether have sufficient reserves to buffer and maintain a 1:1 peg in times of crisis.

Overall, Tether’s transparency report refutes ongoing liquidity and asset support concerns. The Commodity Futures Trading Commission fined Tether $41 million in October 2021 for disseminating “untrue” statements about its reserve holdings. In contrast, authorities have not flagged any recent Tether transparency reports issued within the last two years.

Today #Tether announces the ending of the support of 3 blockchains $USDt: OmniLayer, BCH-SLP and Kusama.

Customers will be able to continue to redeem and swap $USDt tokens (to another of the many supported blockchains), but Tether won't issue any new additional $USDt on those 3… https://t.co/aghLgqtSuO

— Paolo Ardoino 🍐 (@paoloardoino) August 17, 2023While no new Tether tokens will be issued on the Bitcoin Omni Layer, Kusama, or Bitcoin Cash in the future, redemptions will be available for at least one year following the announcement.

The OmniLayer team “faced challenges due to the lack of popular tokens and the availability of USDT on other blockchains,” which prompted exchanges to use other transport layers rather than Omni. Tether stated that it would contemplate re-releasing the Omni Layer version if Omni usage increases.