Midas investment a custody-based CeDeFi platform will cease operations due to a $63.3M loss in its decentralized finance (DeFi) portfolio, as users withdrew more than 60% of their assets under management due to the crypto market decline.

Iakov Levin, popularly known as “Trevor,” the company’s founder and CEO, said in a statement that the decision was made in part due to the fund’s DeFi portfolio losing $50 million, or 20% of its $250 million in assets under management (AUM).

Levin also emphasized how their troubles were exacerbated by the failure of the Terra, FTX exchange, and Celsius. Following the LUNA, Celsius, and FTX disasters, 60% of the cash was withdrawn by users, according to the creator of Midas. Levin penned:

“We experienced an outflow of assets of more than 60% over the course of six months due to events involving LUNA, Celsius, and FTX. This made it impossible for us to sustain our fixed yield model.”

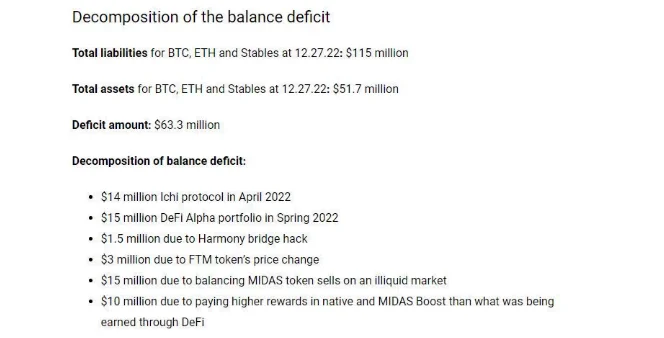

The company’s total liabilities in Bitcoin, Ether, and stablecoins are $115 million, but its present assets are estimated to be worth $51.7 million, according to the release. This results in a $63.3 million loss overall.

The creator also mentioned Midas’ future plans to provide CeDeFi methods for users of CeFi and DeFi, starting a new initiative in an effort to establish a new “win-win scenario.” According to Levin, liquidity will be used to link rival protocols.

DeFi platform Defrost Finance just revealed how it intends to reimburse consumers, and in the meanwhile, it has finally spoken up in response to claims that it pulled a “rug pull” after the recent $12 million exploit on its platform. According to the Defrost team, a compromised key does not equal a rug pull.

Avraham Eisenberg was just detained and charged, according to other DeFi sources. The Federal Bureau of Investigation charged Eisenberg with commodities fraud and commodities manipulation as a result of the Mango Markets exploit in a complaint that was made public on December 27.