Increased crude oil prices due to recent conflict between Israel and Hamas leads to liquidity pressure for Bitcoin and other cryptocurrencies.

After a robust start to the month of October 2023, Bitcoin and the broader cryptocurrency market remained quite volatile during the first week. Bitcoin posted modest gains and is currently trading near $28,000. In contrast, altcoins have experienced some selling pressure.

The 10-year Treasury yields have soared to 16-year highs due to developments in the conventional finance market, which have dampened the crypto market’s rally.

Important Macrotrends for Bitcoin Investors

This week, an abundance of crucial macroeconomic data will be released. Consumer Price Index (CPI) and Producer Price Index (PPI) data for September will be released by the United States, while the Federal Reserve will release the minutes from its September meeting. In addition, several Federal Reserve officials are scheduled to deliver presentations.

As the US central bank prepares for an additional rate hike in 2023, investors will scrutinize the Fed’s commentary in the future. Consequently, investors are proceeding with caution due to the lack of a discernible trend.

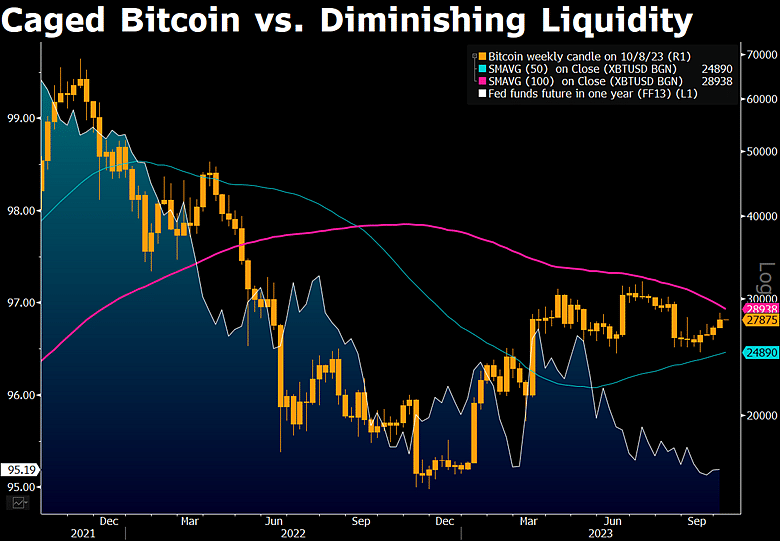

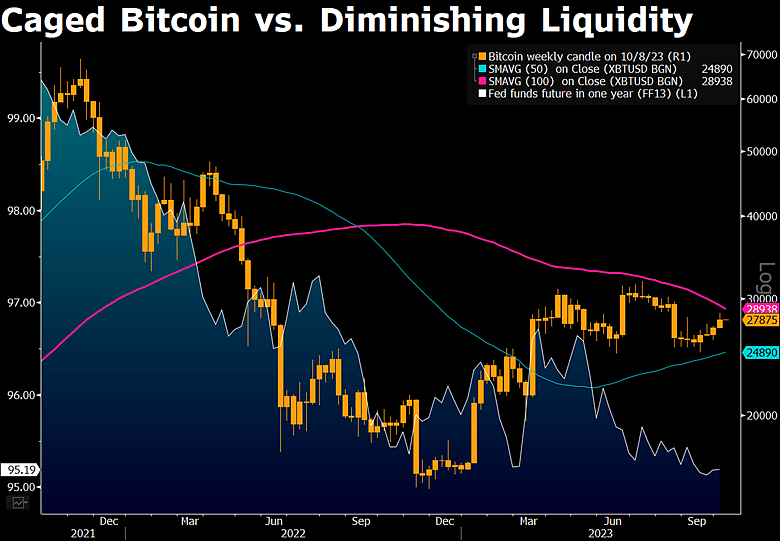

As a result of the recent escalation between Hamas and Israel, Bloomberg’s senior commodity strategist Mike McGlone believes Bitcoin is exhibiting a “risk-off” disposition.

He believes the 100-week moving average with a downward slope is more likely to prevail than the 50-week moving average with an upward slope. McGlone also observes that increased crude oil prices contribute to market liquidity pressure.

Several Positive Bitcoin On-Chain Developments

Bitcoin experienced one of its largest outflow days in over a month over the past weekend. On-chain data provider Santiment explained that Bitcoin has witnessed its most significant movement of coins, comprising over 10,000 BTC, away from exchanges since September 7th.

The cryptocurrency with the largest market capitalization is attempting to surpass the $28,000 price threshold again. The importance of utility is emphasized significantly as the number of unique addresses has dropped to its lowest level in six weeks.

In addition to Bitcoin, the altcoin market has been under pressure to sell, with Ethereum (ETH), Solana (SOL), Cardano (ADA), and others correcting by 3-5% over the past week.