Nearly 1.72 million Bitcoin were transferred between $29,500 and $30,200 in the last 24 hours, which could serve as a formidable resistance.

The largest cryptocurrency in the world has remained rangebound for over a week, with the BTC price currently dabbling with $30,000 levels. However, investors remain uncertain about where the BTC price will head next.

Currently, Bitcoin is experiencing some selling pressure and is struggling to maintain a price above $30,000. Citing on-chain data from Glassnode, prominent crypto analyst Ali Martinez reported that approximately 1.72 million BTC were transferred between $29,500 and $30,200 within the last 24 hours. This range is regarded as a substantial area of resistance.

This range may become a support level, so keep closely watching it. If this occurs, we can anticipate positive and thrilling price movements!

#Bitcoin | On-chain data shows that 1.72 million $BTC last moved within the $29,500 – $30,200 price bucket, representing a significant area of resisitance.

Wait until it becomes support and expect fireworks when it does! pic.twitter.com/vhlKVh3wsg

— Ali (@ali_charts) July 23, 2023The analyst also reported that the daily BTC chart displays a buy signal according to the TD Sequential indicator. If the everyday closing price surpasses $30,000, the bullish pattern can be confirmed, leading to a rise from $30,400 to $30,600.

However, it is essential to exercise caution around $29,500. If there are any signs of weakness or a decline in support at this level, the buy signal could be invalidated.

#Bitcoin | The TD Sequential shows a buy signal on $BTC daily chart. A daily close above $30K could validate the bullish formation leading to an upswing to $30.4K – $30.6K.

Watch out for the $29.5K level, as any signs of weakness at this support could invalidate the buy signal. pic.twitter.com/eOBiiYxPoJ

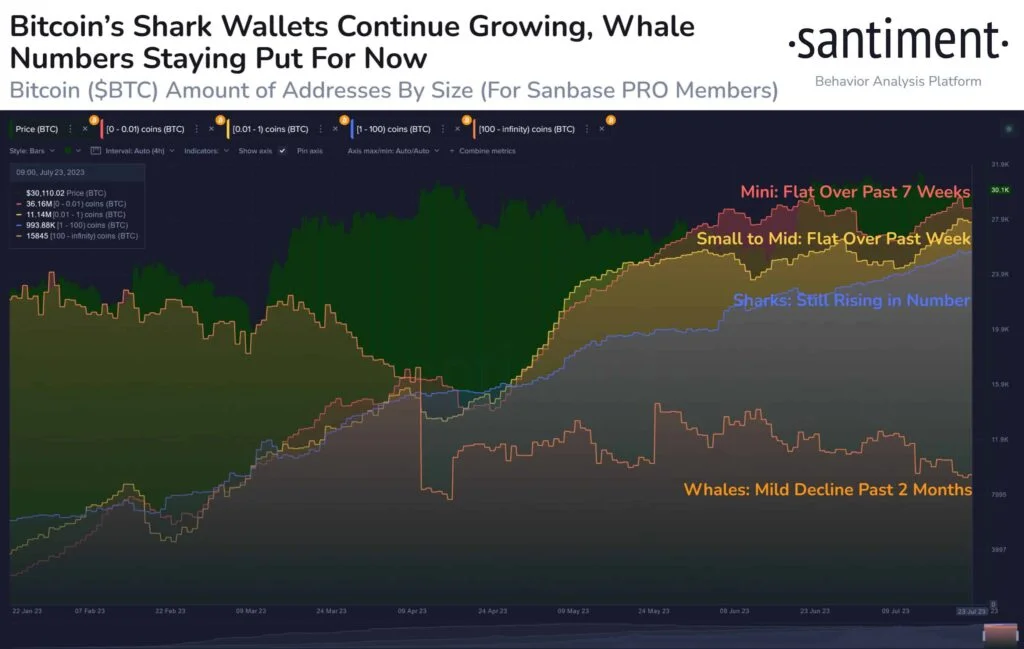

— Ali (@ali_charts) July 23, 2023Bitcoin Sharks Amass: While Whale Wallets Pause

On-chain data also indicates that Bitcoin sharks have continued to amass during this consolidation period. However, sharks have stopped for the time being. On-chain data provider Santiment writes:

“Bitcoin has rebounded back above $30k this weekend, and it’s recommended to keep an eye on the number of large addresses as summer progresses. If the 100+ $BTC wallet line begins rising again, another breakout greatly increases in probability”.

Despite this, some market analysts remain bullish on Bitcoin despite the impending halving event within the following year. Geoff Kendrick, an analyst at Standard Chartered, believes that Bitcoin miners are generating a positive cycle that could drive the token’s price even higher than the optimistic forecasts

Positive trend: when Bitcoin prices increase, producers tend to sell fewer tokens. Earlier this month, he predicted that Bitcoin’s price could reach $120,000 next year, a significant increase of 300 percent from its current value.