Hayden Adams, the CEO of the Uniswap protocol, denied allegations that Uniswap demanded payment from decentralized financing protocols for deployments on X.

On September 12, the CEO of Uniswap Labs and Uniswap Foundation stated on the social media platform X that there are no fees associated with protocol deployments.

Adams stated that protocol deployments occur through governance ballots. He clarified that the requirements for deployment on a new chain within the Uniswap interface are contingent upon the activity and effort required per chain.

The CEO of Uniswap responded to allegations made by X user @wagmialexander that the company requested $20 million for an ineffective Uniswap deployment.

In response to a tweet from Kene Ezeji-Okoye, the co-founder of Millicent Labs, who claimed that Uniswap charges $10 million for protocol deployments “and an extra $10 million in user incentives focused on trading carbon credits,” the allegation of Uniswap accepting deployment bribes was made.

The Uniswap protocol is an open-source protocol that facilitates trading ERC20 tokens on the Ethereum blockchain and provides liquidity. Uniswap Labs developed the Uniswap protocol and interface.

Uniswap resolves dispute with US regulator

Uniswap was recently involved in a regulatory dispute with the United States Commodity Futures Trading Commission (CFTC).

Illegally offering leveraged cryptocurrency trading to retail investors in the United States, the regulator suspended Uniswap Labs on September 4.

By pledging to refrain from violating the Commodity Exchange Act and paying a $175,000 civil penalty, Uniswap Labs resolved the charges brought against it by the CFTC.

Uniswap sees itself as a software corporation

The Securities and Exchange Commission (SEC) of the United States (SEC) accused Uniswap of operating an unregistered securities exchange in April.

In its response, Uniswap stated that it is a software corporation headquartered in New York that “reimagines market structures” and is not “an exchange, broker, or clearing firm under any reasonable reading of the securities laws.”

“Certainly, I am displeased that the SEC appears to prioritize the protection of opaque systems over the protection of consumers.” CEO Adams wrote on X, “And we will have to fight a US government agency to protect our company and industry.”

With the ability to facilitate token exchanges on over a dozen blockchain networks, Uniswap is one of the most widely used decentralized finance protocols.

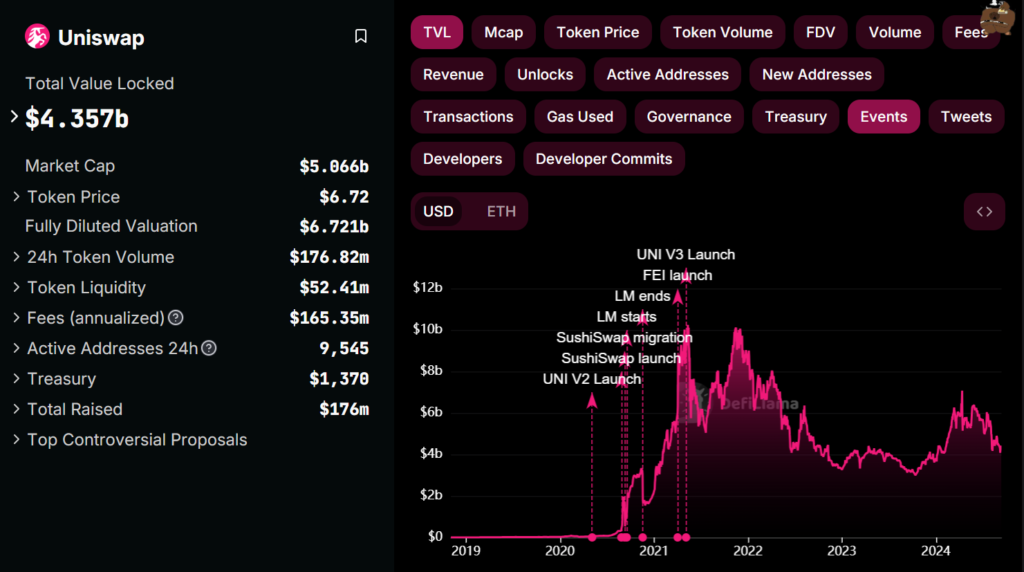

According to DefiLlama, Uniswap had approximately $4.35 billion in total value locked (TVL) as of September 12.