Bitpanda, a cryptocurrency broker based in Vienna, has completed its third significant private fundraising round, headed by Valar Ventures, founded by Peter Thiel.

The company is now valued at $4.1 billion after raising $263 million and attracting new investments from British billionaire hedge fund manager Alan Howard and REDO Ventures.

That’s three times the company’s previous valuation, which was $1.2 billion when it raised $170 million in March of this year.

Bitpanda has now secured about $500 million in private funding rounds, with three-time backer Valar Ventures and repeats investors LeadBlock Partners and Jump Capital among them.

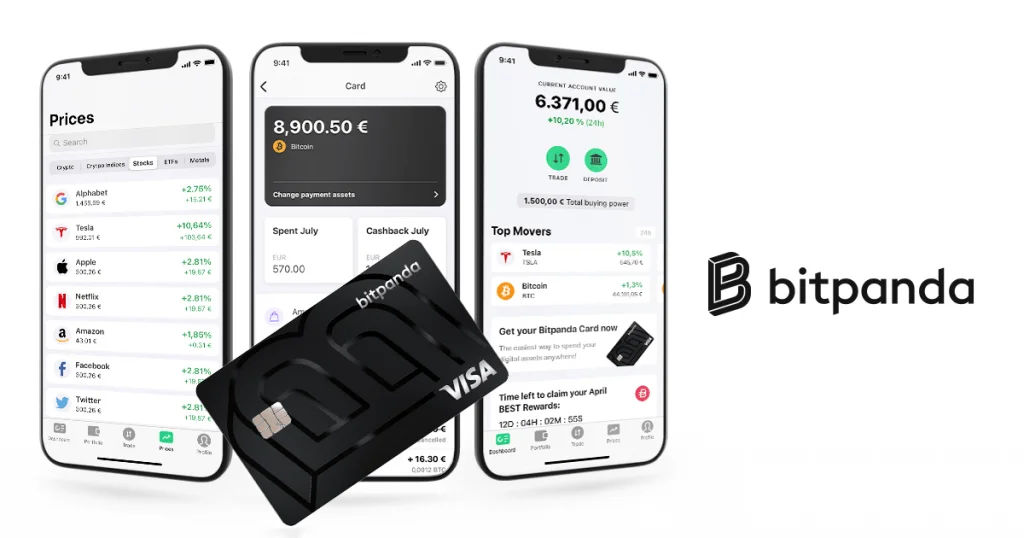

The company has specialized in cryptocurrency and precious metals brokerage since 2014. The site is now testing a stock trading service that will be available 24 hours a day, seven days a week.

Bitpanda co-founder and CEO Eric Demuth said in an interview with CNBC that the stock offering will most likely be ready by the end of the year.

The new service would put Coinbase on par with very successful stock trading applications like Robinhood, whose profile — as well as trade volumes and, arguably, notoriety — soared after the Gamestop scandal earlier this year.

Bitpanda’s profitability is one of its distinctive features; according to Demuth, the firm has been profitable for the previous five years and, while not giving its actual annual sales to reporters, is ostensibly on schedule to raise them sevenfold in 2021.

It stands out from both with over three million customers, which is still much less than rivals like Robinhood and Revolut.

Early this year, the latter’s IPO filing indicated a $1.4 billion quarterly loss, and Revolut lost more than $230 million in 2020, up 57% from 2019.

Bitpanda had secured investment from Robinhood sponsor DST Global in its March 2021 round, but it has not been publicly announced as a participant in this newest round as of writing.

Bitpanda is a European-only company that wants to use the fresh capital to grow into other markets such as France, Spain, Italy, and Portugal.

The company has no intentions to go public in the near future, although Demuth has praised Wise’s recent direct listing on the London Stock Exchange, which followed a model pioneered by Spotify on the New York Stock Exchange in 2018.

He has ruled out an IPO through a merger with a SPAC, which is how stablecoin issuer Circle plans to go public on the NYSE later this year.