Worldwide investment manager and ETF giant VanEck has filed for a Solana ($SOL) Exchange-Traded Fund (ETF) in Germany, If accepted, the ETF would allow for direct Bitcoin investment.

According to reports, VanEck, a worldwide investment manager and ETF provider, has registered for a Solana ($SOL) ETF in Germany.

This reflects an increased institutional interest in Solana, a relatively new cryptocurrency that has had a stellar two months, achieving new highs and entering price discovery mode. Since August, the altcoin has risen over 7X, from just under $35 to a fresh high above $210.

VanEck is a giant in the ETF world, and its growing interest in the crypto industry will further accelerate adoption.

In 2017, the ETF management was one of the first to register for a Bitcoin ETF with the US Securities and Exchange Commission (SEC), and the SEC now has two Bitcoin ETF proposals pending.

If accepted, the first registration would allow for direct Bitcoin investment, while the Bitcoin Strategy ETF filing would allow for Bitcoin Futures investment.

Solana was chosen, according to VanEck, because of its scalability solution, which is among the best among Layer-1 protocols on the market. VanEck’s head of digital assets research, Matthew Sigel, stated,

“The idea that you could get 50,000 transactions per second, which would rival Nasdaq, opens up the potential to just securitize any number of existing assets, tokenize them and trade them in parallel using the Solana network,”

VanEck’s plan might rekindle interest in the seventh-largest cryptocurrency by market capitalization, whose reputation took a hit after the network was taken down for over 24 hours due to a fault.

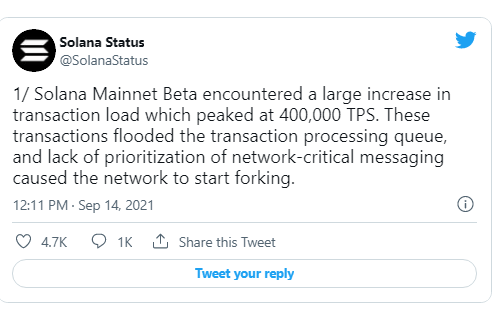

Last week, the Solana blockchain experienced an outage as a result of a number of unidentified transactions making their way into multiple pools, causing some nodes to crash.

While many Ethereum supporters used the chance to point out problems in so-called “Ethereum Killers,” Solana creator said it was all part of the process.

$SOL is currently experiencing a downtrend along with the rest of the market, and even though it looked set on the path to recovery after the restart of the network, the current bearish downtrend could see its price retrace to $100 levels. $SOl was trading at $135.79.