It is critical to have an understanding of the assets and technologies involved in cryptocurrency trading before even considering it. This article gives a thorough exposition to trading for both beginner and advanced traders.

Bitcoin (BTC) is the seed that has sprung thousands of different cryptocurrencies. As a result, it is beneficial to first comprehend the underlying asset from which the crypto sector arose.

Read Cointelegraph’s “What is Bitcoin?” tutorial for a comprehensive overview of the cryptocurrency.

If you want to pursue this highly speculative and risky approach to accumulating value in the crypto economy, the following guide will walk you through the absolute fundamentals of cryptocurrency trading, including the components of trade, trading styles, and the role of technical and fundamental analysis in developing a comprehensive trading strategy.

Trading cryptocurrencies, like stocks and other financial markets, can be complicated, including a variety of components and needing understanding.

Bitcoin was the first crypto asset to be introduced in 2009, and it is still the most popular cryptocurrency in terms of market value and usage.

However, over time, a whole industry of other digital assets has sprung up, with the assets being traded for profit. Altcoins are all other cryptocurrencies that aren’t Bitcoin, the most popular of which being Ether (ETH).

In terms of how to trade cryptocurrencies, there are a variety of techniques. To begin trading cryptocurrencies, one must first have a thorough understanding of the subject.

It’s also crucial to understand the hazards and legislation that may apply in one’s region and to make judgments based on that knowledge.

Please note that the following is intended to be a basic instruction for the novice to better understand how trading works, not a step-by-step guide that guarantees a profit.

In whatever market, trading is and always will be a dangerous business. Before interacting or trading with any asset, technology, business, or human, always conduct your own research.

The fundamentals of cryptocurrency trading

A market that never sleeps determines the value of Bitcoin second by second, day by day. Bitcoin, being an autonomous digital asset whose value is determined by an open market, has inherent volatility concerns that conventional currencies do not.

As a result, it’s critical for newbies to have a basic understanding of how crypto-asset markets work so that they may securely navigate the markets, even if only on a temporary basis, and get the most value out of their crypto involvement.

Bitcoin trading can range in scale and complexity from a simple transaction, such as cashing out to a fiat currency like the US dollar, to profitably riding the market in order to expand one’s investment portfolio using a number of trading pairings. Naturally, as the magnitude and complexity of trade grow, so does the trader’s risk exposure.

Let’s start with some fundamental notions.

A trade’s structure

A buyer and a seller make up a trade. Someone is bound to benefit more than the other in a trade because there are two opposing sides – a purchase and a sale.

As a result, trading is always a zero-sum game: there is a winner and a loser. Knowing how the cryptocurrency markets work on a fundamental level will help you reduce potential losses and maximize potential gains.

When a buyer and seller agree on a price, the trade is completed (via an exchange) and the asset’s market value is established. Buyers, on the whole, place orders at lower prices than sellers. This is how an order book’s two sides are made.

When there are more buy orders than sell orders, the price often rises since the asset is in higher demand. When there are more people selling than buying, the price drops.

Buys and sells are shown in different colours in several exchange interfaces. This is done to provide the trader with a rapid sense of the market’s current state.

You’ve probably heard the trading saying, “buy low, sell high.” Although the adage does give a basic picture of the incentives of buyers and sellers in a marketplace, it can be difficult to navigate because high and low prices are relative.

To put it another way, if you want to buy anything, you want to spend as little money as possible. If you want to sell something, you want to get the most money out of it. While this is sound advice in general, there is also the distinction between yearning and shorting an asset.

Buying an asset and profiting from its upward price movement is known as going long on it (longing). Going short on an asset (shorting), on the other hand, is selling an asset with the purpose of repurchasing it when its price falls below the point at which you sold it, so benefitting from a price reduction.

Shorting, on the other hand, is a little more sophisticated than this simple explanation and entails selling borrowed assets that will be repaid later.

The art of market analysis

To the untrained eye, “the market” may appear to be a sophisticated system that only an expert could comprehend, but it all boils down to people buying and selling.

The total number of active buy and sell orders in a market at any particular time represents a snapshot of the market. Reading the market is the process of detecting patterns or trends over time and deciding whether or not to act on them. There are two market patterns in general: bullish and bearish.

When the price activity looks to be continually increasing, it is called a “bullish” market. As a result of the flood of purchasers, these upward price fluctuations are referred to as “pumps.”

When the price action looks to be steadily decreasing, it is referred to be a “bearish” market or bear market. As a result of the huge sell-offs, these downward price movements are frequently referred to as “dumps.”

Depending on the time period used, bullish and bearish trends can also exist inside broader opposing trends. A tiny bearish trend, for example, could develop within a larger long-term bullish trend.

In general, price activity in an uptrend makes greater highs and lower lows. Lower highs and lower lows characterize a downtrend.

When the price trades sideways or inside a range, this is referred to as “consolidation.” Consolidation periods are more visible on higher time frames (daily or weekly charts) and occur when an item is cooling off after a strong upward or downward trend.

Consolidation can also occur before a trend reversal or when demand is low and trade volumes are low. During this market situation, prices effectively trade in a range.

Technical analysis

Technical analysis (TA) is a way of forecasting price movement by evaluating prior market data, especially price and volume.

While there are many different types of TA indicators that a trader can use to assess the market, here are some basic macro-and micro-level tools.

The structure and cycles of the market

Traders can recognize patterns in hours, days, and months of varying market movement, and they can also uncover patterns in years of fluctuating price action. The market has a basic structure that makes it prone to certain tendencies.

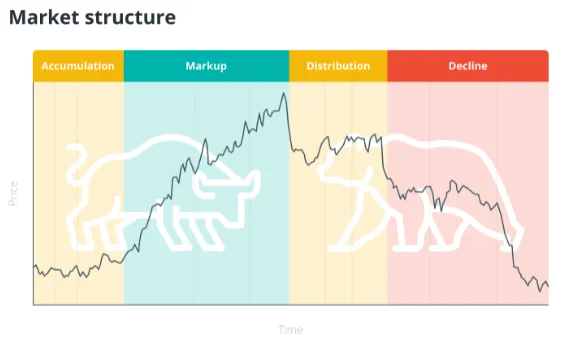

Accumulation, markup, distribution, and decline are the four key parts of the cycle. As the market transitions between these phases, traders will adjust their holdings as needed by consolidating, retracing, or correcting their positions.

The bull and the bear are two extremely different animals that act in antagonism to one another in the same environment. It’s vital for a trader to understand not just which function they fit into, but also which one is now ruling the market.

Not only is technical analysis required to place oneself in this ever-changing market, but it is also required to actively navigate the ebbs and flows as they occur.

The pursuit of the whale

Price changes are typically influenced by “whales,” or people or groups with huge trading capital. Some whales work as “market makers,” putting up bids and offers on both sides of the market to create liquidity for an asset while also making a profit. Whales can be found in almost every market, including stocks, commodities, and cryptocurrency.

Whales‘ favourite instruments of the trade, such as their preferred TA indicators, must be considered in a trading strategy. Simply said, whales have a good sense of direction. By anticipating whales’ intentions, a trader can work in tandem with these adept movers to profit from their own plan.

Psycological cycles

With a zoo full of metaphors, it’s easy to forget that, for the most part, real people are behind these trades and, as a result, are vulnerable to emotional behaviours that can have a major impact on the market.

While the bull/bear paradigm is useful, the psychological cycle shown above gives a more complete picture of market emotion.

While leaving emotion at the door is one of the first laws of trading, the strength of group mentality tends to take hold.

FOMO (fear of missing out) from people who haven’t yet positioned themselves in the market is driving the rise from hope to exhilaration.

Timing an exit before the bears take control and people panic sell requires navigating the valley between euphoria and complacency.

It’s crucial to take into account high-volume price activity, which can reveal the market’s overall trend. Given that the greatest moment to accumulate within the market cycle is during a depression following a significant price decline, the “buy low” mentality is self-evident. The more the risk, the bigger the payoff.

The professional trader’s task is to avoid letting emotion dictate their trading approach in the face of a barrage of hot takes and analysis from the media, chat rooms, and so-called thought leaders.

These marketplaces are prone to manipulation by whales and anyone with the ability to influence the market’s pulse. Make sure you’ve done your homework and are taking decisive action.

Basic equipment

It’s critical to be able to spot market patterns and cycles in order to have macro-level clarity. It’s critical to understand where you stand in relation to the entire.

Instead of paddling aimlessly in the waves hoping for something wonderful to happen, you want to be the expert surfer who knows when the ideal wave is about to arrive.

However, determining your true plan requires a micro perspective. We’ll merely go over the most fundamental TA indications because there are so many.

Support and resistance

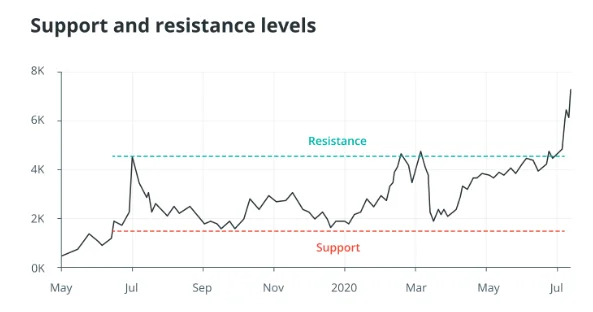

The terms “support” and “resistance” are two of the most often used TA indicators, and they refer to price barriers that arise in the market, limiting price action from going too far in one direction.

The price level at which the downward trend tends to stall due to an infusion of demand is known as the support. Traders tend to purchase low when prices fall, forming a support line. The price level at which the upward trend tends to stall due to a sell-off is known as resistance.

Many traders wager on the direction of the price using support and resistance levels, changing on the fly as the price level breaks through its upper or lower bounds.

Once traders have determined the floor and ceiling, they can enter or exit positions in a zone of activity. The common standard operating procedure is to buy on the floor and sell on the ceiling.

If the price breaks through these hurdles in either direction, it indicates the market’s overall mood. This is a continuous process because when a trend breaks through, new support and resistance levels tend to arise.

Trendlines

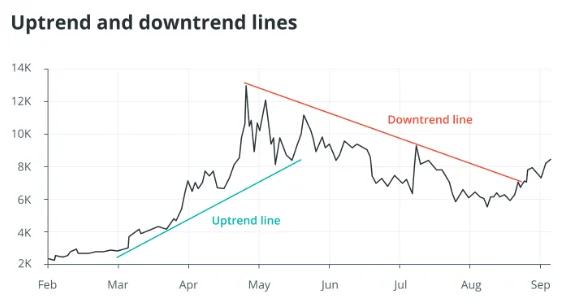

While traders frequently employ the static support and resistance barriers depicted above, price movement tends to trend higher or lower, with barriers moving over time.

A trendline is a series of support and resistance levels that can indicate a bigger market trend.

When a market is heading upward, resistance levels arise, price action slows, and the price is drawn back to the trendline.

Traders pay particular attention to the ascending trendline’s support levels, as they signal a zone that helps keep the price from falling too far.

Similarly, traders will keep an eye on the series of dropping peaks in a downward trending market in order to connect them into a trendline.

The market’s history is the most important factor. As time passes, the strength of any support or resistance levels, as well as the trendlines that arise, grows.

As a result, traders will keep track of these roadblocks in order to inform their ongoing trading strategy.

Round numbers

The obsession with round-number price levels by inexperienced or institutional investors has an impact on support/resistance levels.

When a big number of trades cluster around a good round number — such as when Bitcoin’s price approaches a figure equally divisible by $10,000, for example — it can be difficult for the price to break over this barrier, forming resistance.

This regular occurrence demonstrates that human traders are quickly swayed by their emotions and are prone to taking shortcuts. When a specific price point is reached in Bitcoin, it usually results in an eager rush of market action and expectation.

Moving averages

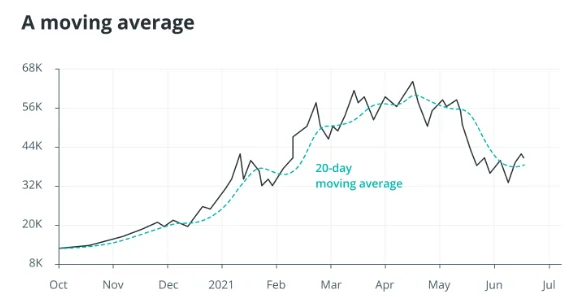

Traders often smooth the market history of support/resistance levels and the resulting downward/upward trendlines to generate a single visual line representation known as the “moving average.”

In an upward trend, the moving average smoothly lines the bottom support levels, while in a downward trend, it traces the peaks of resistance. The moving average is a valuable measure of short-term momentum when studied in relation to trading volume.

Patterns on the graph

There are several methods for charting the market and identifying patterns. The “candlestick” is one of the most common visual representations of market price action. These candlestick patterns provide a visual language for traders to predict probable trends.

Candlestick charts were developed in Japan in the 1700s as a tool for measuring how traders’ emotions influence price activity in ways that go beyond standard supply-and-demand economics.

This market visualization is one of the most popular among traders since it can hold more information than a standard line or bar chart. There are four price points on a candlestick chart: open, close, high, and low.

Because of their rectangular design and the lines above and/or below that mimic a wick, they’re called candlesticks. Depending on the colour of the candle, the price opened or closed in the wide portion.

The wicks depict the price range in which an asset traded throughout the candlestick’s set time. Candlesticks can represent a variety of time periods, ranging from one minute to one day and beyond, and can display a variety of patterns based on the timeline selected.

Analytical foundations

So, how do we assess a crypto asset’s potential based on factors other than or in addition to its market performance?

Fundamental analysis is the study of the underlying industry, technology, or assets that compose a given market, whereas technical analysis is the study of market data in order to develop one’s trading strategy. A cryptocurrency trading portfolio will almost certainly include Bitcoin and altcoins.

How can you tell if an asset is based on solid fundamentals rather than hype, overblown technology, or worse, nothing at all? Several criteria should be examined while conducting a fundamental study of new assets:

Developers

It is critical to assess the integrity and skill of the builders behind an asset before investing in it. What kind of track record do they have? What software ventures have they previously brought to market? How involved are they in the development of the token’s underlying protocol? Because many projects are open-source, collaborative code repository services like GitHub can provide direct access to this activity.

Community

Cryptocurrency initiatives require a strong community. Much of the driving energy behind these assets and their underlying technologies comes from the combination of users, tokenholders, and enthusiasts. After all, any new technology always has a social component.

However, because there is a lot of money at stake — and because non-professional retail investors are frequently there — the space is prone to divisiveness and feuding factions. As a result, a healthy, open dialogue within the community is desirable.

Technical requirements

The network’s choice of algorithm (how it maintains security, uptime, and consensus) and issuance/emission features like block times, the maximum token supply, and the distribution plan is among the core technical specifications for a crypto asset, which are not to be confused with market technical analysis.

A trader can determine whether such qualities support a potential investment by carefully examining the protocol stack of a cryptocurrency network as well as the monetary policy enforced by the protocol.

Innovation

While electronic money was Bitcoin’s original use case at the time of its debut, engineers and entrepreneurs have not only identified additional uses for the blockchain but have also created wholly new protocols to support a wider range of applications.

Availability of liquid assets (and whales)

A healthy market requires a high level of liquidity. Is a certain crypto asset supported by trustworthy exchanges? If that’s the case, what trading pairings are available? Is there a sufficient amount of trading/transactions? Is there a presence of significant players in the market, and if so, what impact do their trading patterns have?

However, because a new creative protocol may be live but not have quick access to liquidity, generating liquidity takes time.

Such investments carry a high level of risk. You’re effectively wagering that a healthy market will grow around the project if volumes are low and there are few to no trading pairs available.

Marketing and branding

Most cryptocurrency networks lack a single figure or corporation to facilitate branding and marketing around their technology, resulting in branding that may be disjointed or lacking in focus.

This is not to dismiss the branding and marketing that a protocol develops over time; in fact, a comparison of the marketing efforts of core developers, corporations, foundations, and community members can provide a detailed overview of how certain players communicate value propositions to the general public.

Infrastructure

This quality can be thought of as the physical expression of a project’s technological requirements. What is the actual physical embodiment of the protocol in question, regardless of what is published in white papers or presented at conferences?

The stakeholders should be identified: developers, block validators, merchants/companies, and users. It’s also important to know who the network’s stewards are, what function they play in safeguarding the network (mining, validation), and how authority is dispersed among various stakeholders.

On-chain analyses

Given that all cryptocurrencies are based on blockchain technology, a new sort of analysis (on-chain) has emerged that uses data from blockchains.

Analysts can make precise qualitative and quantitative observations about the strength of a cryptocurrency’s blockchain network, as well as its price dynamics in a variety of markets, by looking at supply and demand trends, transaction frequency, transaction costs, and the rate at which investors are holding and selling a cryptocurrency.

Analysts can connect various macro and microeconomic events with the activities of investors, which are immutably recorded on the blockchain, using on-chain data to gain important insight into investor psychology.

To forecast potential future price movements and investor reactions to upcoming events such as network upgrades, coin supply halvings, and actions taking place in traditional financial markets, analysts look for patterns and anomalies in buying, selling, and holding behaviour in correlation to market rallies, sell-offs, regulatory events, and other network-oriented events.

Trading is a risky business.

Risk management is an important component of trading as well. Before you initiate a deal, you should determine how much you are willing to lose if the trade goes against you. This can be determined by a variety of things, including your trading capital.

For example, a trader may only want to risk losing 1% of their total trading capital or 1% of their total trading capital each trade.

Trading is a high-risk activity in and of itself. It’s nearly hard to anticipate market action in the future with any degree of precision.

Finally, it is critical to make your own decisions based on available facts and your own judgment, as well as to ensure that you are well educated.

Furthermore, trading techniques can vary greatly from one person to the next, depending on personal preferences, personalities, trading money, risk tolerance, and other factors.

Trading entails a great deal of responsibility. Before deciding to trade, everybody considering it must assess their own personal situation.