Wall Street giants predict that the US CPI and Core CPI will continue to decline, and that the Bitcoin price rally will continue.

Cryptocurrency and stock market investors eagerly anticipate the U.S. Bureau of Labor Statistics’ January consumer price index (CPI) inflation data for additional indications of Fed rate cuts. Bitcoin is trading above $50,000 as a result of a substantial rally in the cryptocurrency market sparked by a massive purchase of spot Bitcoin ETFs.

CPI and Core CPI Expectations

Wall Street titans anticipate a significant decline in CPI and core CPI inflation, particularly in light of the recent CPI revision. Although Fed officials are hesitant to reduce interest rates in March, the outlook for monetary policy will be better illuminated by the forthcoming economic data.

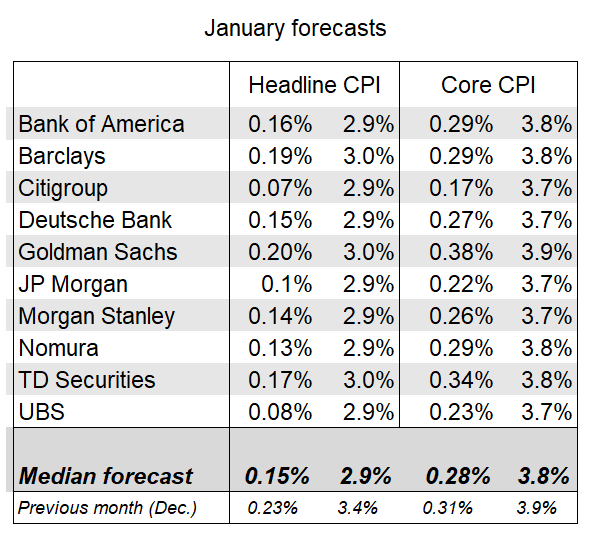

According to JPMorgan, Bank of America, UBS, Morgan Stanley, Citigroup, Deutsche Bank, Nomura, and RBC forecasts, headline CPI inflation will decline from 3.4% to 2.9%. Wells Fargo, Barclays, Goldman Sachs, and T.D. Securities predict a 3% decline.

In contrast, analysts from Citigroup, Deutsche Bank, JPMorgan, Morgan Stanley, and UBS predict a decline in the core CPI from 3.9% to 3.7%.

Bank of America, Barclays, T.D. Securities and Nomura forecast an annual core rate of 3.8%, while Goldman Sachs projects an even higher rate of 3.9%.

As a result, the market anticipated that the annual inflation rate would decline to 2.9% in January, the lowest level since March 2021. Moreover, annual core inflation is anticipated to decelerate to 3.7%, the lowest since April 2021. The monthly rates for the CPI and core CPI are anticipated to remain unchanged at 0.2% and 0.3%, respectively.

Will Bitcoin Reach $55,000?

The evidence that the CPI inflation is declining will enable the Federal Reserve to contemplate reducing interest rates in the coming months. The CME FedWatch Tool indicates that 25 basis point rate decreases are probable by nearly 50% in May and a significant margin in June.

Macroeconomic indicators are currently indicating volatility, which forces traders to remain vigilant. The U.S. dollar index (DXY) is 104, down from 104.25. In anticipation of a further upward movement in the price of Bitcoin to $55,000, crypto traders anticipate a decline below 104.

Furthermore, the 10-year Treasury yield (US10Y) continues to hover above 4% despite a decline. The recent auctions of Treasury bills and the cautious outlook of Fed officials regarding rate cuts.

The futures and options market appears robust as new wagers are placed by traders anticipating further BTC price appreciation. Over 7% more Bitcoin futures are traded at $47.32 billion, and the volume of futures has increased by 70% over the past twenty-four hours.

Total options open interest increased by 4% to $24.29 billion, driven by a substantial inflow of spot Bitcoin ETFs and a colossal 7.20 percent increase in CME BTC Futures open interest.

For February, Deribit Options traders are placing increased wagers of $56,000, $60,000, and even $70,000. It suggests that Bitcoin’s price will likely remain above $50,000 following the CPI release.

Twenty-four hours have passed since the BTC price increased by 4%, and it is currently trading at $50,100. The 24-hour moving average is $50,358, and the 24-hour minimum is $47,745. In addition, the trading volume has increased by nearly 100 percent over the past twenty-four hours, suggesting a surge in investor interest.