On September 9, WazirX hacker moves 5000 ETH worth over $11M via Tornado Cash, increasing crypto security concerns.

The hacker responsible for a major breach of the WazirX cryptocurrency exchange in July has moved 5000 ETH, valued at over $11 million, through Tornado Cash.

This action has raised fresh concerns about the security of digital asset platforms and the tactics used by crypto hackers.

WazirX Hacker Transfers 5000 ETH via Tornado

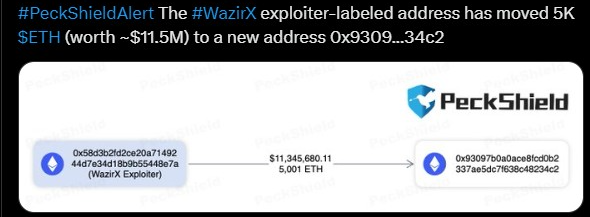

Recently, the WazirX hacker transferred a substantial amount of stolen cryptocurrency, specifically 5000 ETH, to a new address using the Tornado Cash mixing service.

The transaction, which took place at 07:19 UTC on September 9, 2024, involved ether now valued at more than $11 million.

By using Tornado Cash, the transaction trail has been obscured, making it more challenging to trace the assets.

Tornado Cash enhances user privacy by mixing different streams of potentially identifiable cryptocurrency.

Although the service is legal and supports privacy needs, it is frequently used by cybercriminals to launder stolen funds.

This latest transfer is part of a broader trend of significant amounts of stolen crypto being laundered through such platforms.

In response to the attack, WazirX has strengthened its security by upgrading its encryption measures and collaborating with international cybersecurity firms.

WazirX recently announced plans to resolve INR withdrawal issues within two weeks, aiming to release 34% of currently frozen user funds.

These steps come after substantial losses, emphasizing the need for more proactive security measures to combat crypto hacks.

The Broader Context of Crypto Hacks in September

September has seen a surge in cryptocurrency security breaches, with over 20,561 ETH (valued at roughly $49.3 million) laundered through Tornado Cash by various hacking groups.

This rise in illicit activities using privacy-enhancing tools reveals a broader vulnerability within the crypto space.

Among these incidents, the WazirX hacker’s actions stand out, contributing significantly to the troubling trend of crypto hacks.

Additionally, the Penpie exploiter moved 11,261 ETH ($26.7 million) through Tornado Cash just days after their initial theft.

These quick movements highlight the urgent need for more advanced tracking and security mechanisms in blockchain infrastructures.

Following the growing number of hacks, the FBI recently warned Bitcoin ETF issuers and crypto companies about potential security threats from North Korean hackers targeting user funds.

Impact on the Crypto Market

These breaches have consequences that go beyond immediate financial losses, affecting overall market stability and investor confidence.

For example, the price of Ethereum has dropped over 8% in the past week, coinciding with these events.

This market response could hinder the growth of the crypto market, which is already facing regulatory challenges.

Despite the setbacks, WazirX’s WRX token saw a 3.31% increase in price, reaching $0.1278.

The token’s market capitalization stands at $48.8 million, with a 59.51% rise in trading volume, now at $798,844 over the past 24 hours.

This surge in activity may reflect growing trader interest, potentially driven by optimism over the resolution of withdrawal issues.