A possible ETH price collapse is feared by the market after a giant whale dumps approximately 33,000 Ethereum on Binance.

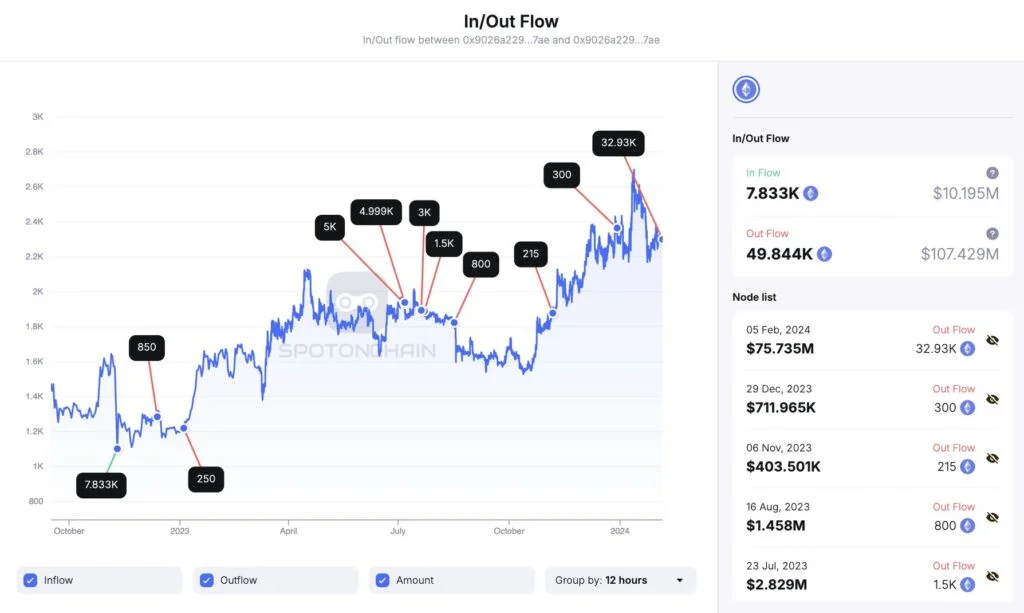

‘czsamsunsb.eth,’ a monstrous cryptocurrency whale identified by on-chain analytics from Spot On Chain, has dumped an enormous 33,000 Ethereum (ETH) onto Binance for an astounding $75.74 million.

The action, witnessed concurrently with the ETH price recovery, is generating concern in the cryptocurrency community due to the whale’s previous practice of transferring ETH to Binance before the market declines.

It is worth mentioning that both investors and analysts are presently maintaining a vigilant eye on the situation, wondering whether this significant decline in value signifies an impending collapse in the Ethereum market.

WhaleTransfers 33,000 Ethereum to Binance

A recent post on the X platform by Spot On Chain highlighted the whale’s decisive action when the token’s value reached $2,300: unstaking and depositing an enormous 32,930 ETH to Binance.

Significantly, this transaction corresponds to the whale’s past conduct of transferring substantial amounts of ETH to Binance before observing noteworthy declines in price.

Conversely, the event schedule, which coincided with indications of market recovery, has incited apprehension among investors and traders. The cryptocurrency community speculates whether this enormous transfer signifies a lack of confidence in the current ETH market trajectory or what potential motivations may be driving it.

The whale currently holds 12,186 staked ETH in the Lido protocol, valued at approximately $28.1 million. However, there remains to be doubt as to whether additional ETH will be withdrawn, which could indicate a lack of confidence in the ongoing recovery efforts.

Price Performance Amid Market Observers Being On High Alert

Market observers are on high alert as the considerable ETH transfer by the whale reverberates throughout the cryptocurrency community. The persistent doubt regarding the whale’s potential execution of additional actions further compounds the uncertainty that envelops the immediate future of Ethereum.

Analysts advise the market to look for possible volatility in the coming days, emphasizing the criticality of closely monitoring trading patterns and whale movements.

It is worth mentioning that at the time of writing, the price of Ethereum had increased by 0.97% in the previous twenty-four hours, reaching $2,313.15. During the same period, its trading volume increased by more than 39% to $6.14 billion. The market capitalization of the second-largest cryptocurrency fluctuated between $2,270.07 and $2,322.65 over the past twenty-four hours.

According to CoinGlass data, open interest in Ethereum futures rose 5.21 percent over the previous twenty-four hours, reaching 3.41 million ETH or $7.91 billion.

Binance and Bybit, in particular, witnessed substantial increases in open interest; Binance’s ETH open interest increased by 3.20% to 1.16 million ETH, valued at approximately $2.69 billion; and Bybit’s ETH open interest increased by 1.61% to $648.57K, equivalent to $1.50 billion.

Those interested in cryptocurrencies are encouraged to exercise prudence and remain informed of real-time market developments, as this substantial whale maneuver introduces an additional level of intricacy to the precarious crypto environment. Due to the far-reaching consequences of such an enormous sell-off, investors must remain informed and adjust their strategies accordingly.