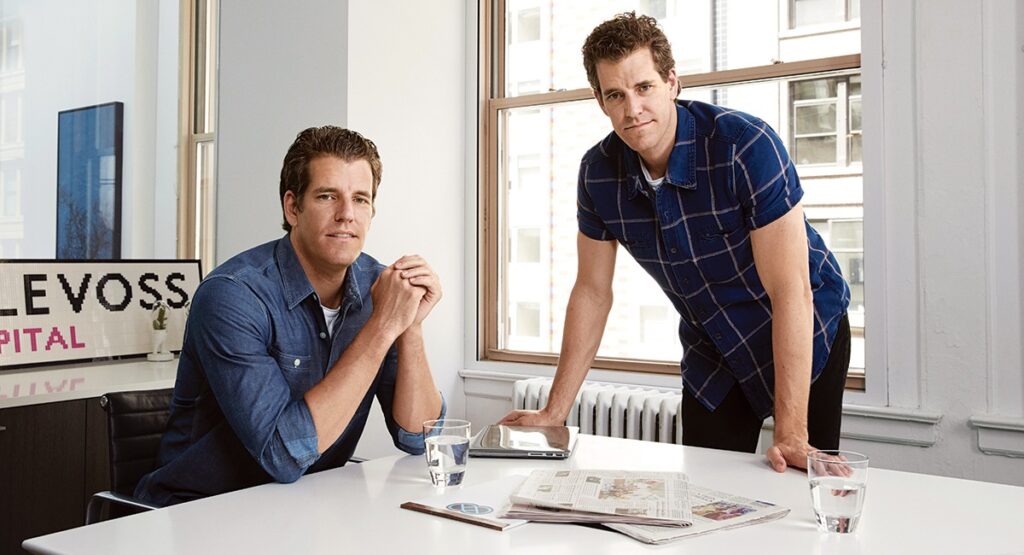

The Winklevoss twins joined Coinbase to urge the US CFTC to overturn its vague event contract restriction that affects Polymarket.

On Saturday, Tyler and Cameron Winklevoss urged the U.S. Commodities Futures Trading Commission (CFTC) to retract its proposed rule on event contracts.

Crypto firms, including Coinbase, have also opposed this rule, which could potentially ban prediction markets like Polymarket.

Winklevoss Twins Urge CFTC to Withdraw Event Contracts Rule

Gemini, the crypto exchange founded by the Winklevoss twins, joined others like Coinbase in pressing the CFTC to retract the proposed rule on event contracts, criticizing it for being vague and expanding the definition of “gaming.”

According to Gemini, the proposal contradicts the statutory framework of the Commodity Exchange Act.

Cameron Winklevoss disclosed that Gemini had sent a letter to the CFTC, asking for the withdrawal of the Proposed Rule on event contracts, which would categorically ban such contracts in the U.S., including those traded on platforms like Polymarket.

“The CFTC should withdraw its Proposed Rule on event contracts, which would categorically ban all event contracts in the U.S., like those traded on Polymarket. Americans should not be denied access to these powerful markets,” Tyler Winklevoss stated.

Due to its significant economic impact, the Winklevoss twins urged the regulator to reconsider the event contract ban proposal.

They emphasized that regulations should be thoughtful and not influenced by political pressure.

They also called on the CFTC to disregard Senator Elizabeth Warren’s push to ban election betting on Polymarket, arguing that it would stifle innovation.

Why the Courts Could Overturn the Rule

The Winklevoss twins further criticized Senator Warren and U.S. SEC Chair Gary Gensler for damaging the integrity and reputation of the SEC.

They urged the CFTC to distance itself from them and focus on what benefits the American people.

Also, they expressed confidence that even if the proposed rule is adopted, it could be overturned by the courts.

Furthermore, they cited the recent Supreme Court ruling in Loper Bright Enterprises v. Raimondo as evidence that regulatory agencies cannot expand their power through rulemaking.

Gemini contended that the CFTC should withdraw the proposed rule rather than limit Americans’ access to these markets.

Commissioner Summer Mersinger noted that the Proposed Rule “exceeds the legal authority that Congress granted the Commission.”