According to the DappRadar NFTs report, blockchain games, a category that has received $2.5 billion in venture capital funding, accounted for 78 percent of all transactions.

According to a new DappRadar analysis, the amount of DeFi transactions was the lowest in a year, while NFT transactions reached an all-time high.

DeFi refers to a set of financial tools available on blockchain networks that enable the trading, borrowing, and lending of crypto assets without the use of third-party intermediaries.

Users of these items have increased significantly in the last two years, albeit the market has now cooled in recent months.

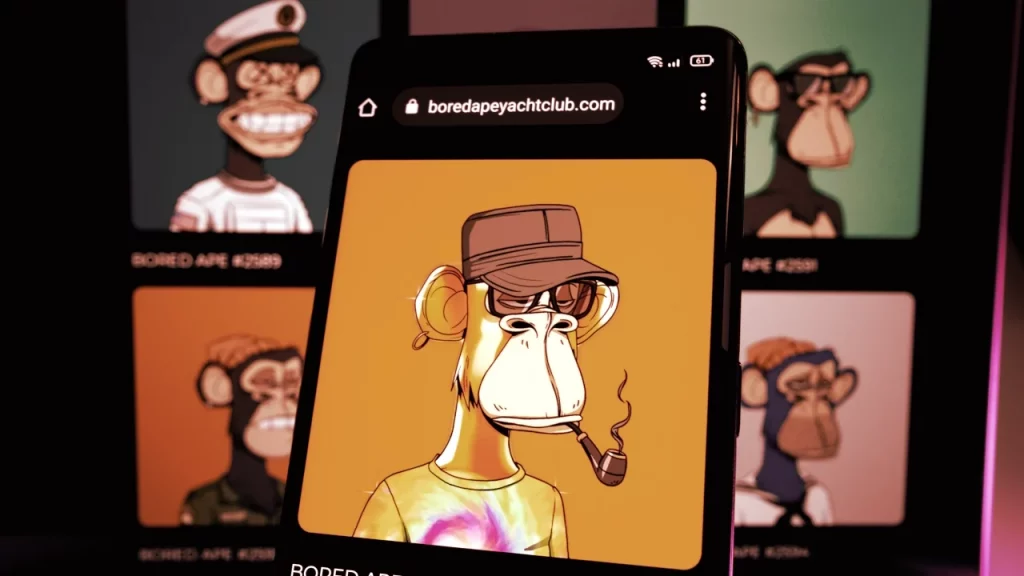

However, NFTs, which are provably unique tokens used to verify ownership of digital assets, has never been more popular.

In the first three months of the year, blockchain analytics firm DappRadar recorded more than 116 million transactions involving NFTs—on decentralized applications and marketplaces—across all blockchains.

This represents a 22 percent increase over the fourth quarter of 2021.

Blockchain games accounted for 78 percent of all blockchain transactions, a 520 percent increase from the previous year.

“We can’t tell for certain that more money is being invested in-game assets,” DappRadar said in a report, “but it might simply be that consumers are interacting more with game dapps.”

However, venture capitalists have clearly taken notice. DappRadar reported in its most recent report that $2.5 billion in venture money had flooded into the play-to-earn category.

The play-to-earn, or GameFi, market is rapidly expanding. This expansion has given rise to companies such as MetaLend, which recently secured a $5 million seed round backed by Pantera Capital.

The company offers financial services to play-to-earn gamers, including loan collateralization with NFTs and funding to gaming guilds.

“The amount of NFT trades in all blockchains also peaked in Q1 2022, up 153 percent from Q1 last year,” DappRadar reported.

“As demand for Ethereum NFTs stabilizes after January’s record levels, the expansion of the NFT market in Layer-1 alternatives, especially Avalanche and Solana, acts as support.”

The Avalanche and Solana networks have seen tremendous growth. Since last year, transaction volume on the blockchains, which have been promoted as Ethereum rivals, has increased by 10,500% and 9,700%, respectively.

Waiting on the Ethereum Merge

The delayed Ethereum merger, which will transition the network from a proof-of-work consensus model to a proof-of-stake consensus model and theoretically boost the blockchain’s efficiency and performance, has played a significant role in fueling the growth of Solana and Avalanche.

According to DappRadar’s data, Ethereum transaction volume has decreased by 58% compared to this time last year.

As more volume exits the Ethereum network, the demand for bridges that connect other blockchains grows. As a result, they’ve become a popular target for thieves, who have already taken about $1 billion through bridge chains.

According to the analytics firm Dune, about $18 billion is currently tied up on Ethereum bridge chains.

This is a $3 billion decrease from a month ago when Axie Infinity’s Ronin bridge was hacked and $622 million in Ethereum and USDC were taken.

According to DappRadar, the vulnerability of bridge chains has increased the number of developers working to safeguard the Cosmos, Solana, and Polkadot networks.