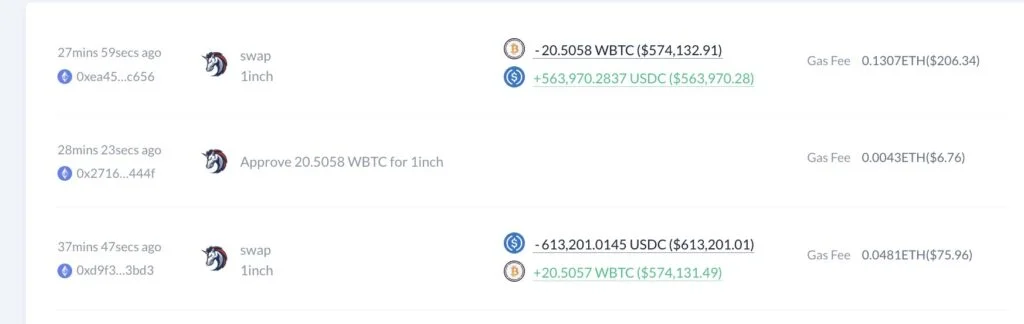

A crypto whale bought 20.5 Wrapped Bitcoin (WBTC) for 613,201 USDC after a false report that the SEC approved a spot Bitcoin ETF, only to sell them for 563,970 USDC in 10 minutes. The incident shows the impact of FOMO and misinformation on the crypto market.

A cryptocurrency whale suffered a huge loss of nearly $50,000 after falling for a fake news report about a spot Bitcoin ETF approval by the SEC.

The investor bought 20.5 Wrapped Bitcoin (WBTC), a tokenized version of Bitcoin on the Ethereum blockchain, for 613,201 USDC, a stablecoin pegged to the US dollar.

However, the investor realized the mistake and sold the WBTC for 563,970 USDC in just 10 minutes, losing 8% of the initial investment.

FOMO: Whale purchases WBTC at a high price

The whale’s costly blunder was triggered by a false report that the SEC had approved BlackRock’s iShares spot Bitcoin ETF application, which would track the actual price of Bitcoin rather than futures contracts.

The report was posted by Cointelegraph, a prominent crypto news outlet, on X (formerly Twitter) without verifying the source.

The source turned out to be an unconfirmed screenshot from an X user who claimed it was from the Bloomberg Terminal.

The false report sparked a buying frenzy among crypto investors, who feared missing out on a potential rally.

The price of Bitcoin surged to nearly $30,000, its highest level since May. The whale apparently followed the crowd and bought WBTC at a premium price of $29,900 per token.

Reality check: Whale sells WBTC at a discount

The whale’s euphoria was short-lived, as BlackRock soon clarified that the report was false and that there was no decision on its ETF application.

The SEC also told The Wall Street Journal that it had no comment on the matter. The crypto market reacted swiftly and corrected itself, with Bitcoin dropping back to $28,000.

The whale must have sensed the trouble and decided to cut the losses by selling the WBTC at a lower price of $27,500 per token.

The whole transaction took only 10 minutes, but it resulted in a significant loss of $49,231.

Significance: The Crypto Market and the News Industry

This incident, which was detailed by Look On-Chain, a platform that provides on-chain data and analysis, illustrates the risks and challenges of trading in the crypto market.

It shows how FOMO – the fear of missing out – can drive irrational and impulsive decisions that can backfire badly.

It also shows how misinformation and fake news can greatly impact market sentiment and price movements.

The incident also highlights the need for more caution and due diligence among crypto investors, especially when dealing with unverified sources and breaking news.

It also underscores the need for more transparency and accountability among crypto news outlets, which should uphold high standards of fact-checking and editorial approval before publishing any news that could affect the market.