Bitcoin reached $88,000 on November 11, with experts predicting it could hit $1 million due to limited supply and institutional interest.

On November 11, the price of bitcoin reached a new all-time high of $88,000, which sparked discussions about the possible price of the cryptocurrency in the future. Bitwise CIO Asset Management, Matt Hougan, suggested that this rise may be a forerunner to Bitcoin hitting valuations in the six-figure range and possibly even one million dollars in the long run.

Hougan noted the robust market characteristics that are driving Bitcoin’s most recent spike, which include growing interest from the holders of Bitcoin for a long period of time and institutional investors.

Bitwise CIO Predicts BTC Can Reach $1M

Market observers attribute the quick ascent of Bitcoin’s price to a combination of rising demand and a limited supply of the cryptocurrency. According to Bitwise CIO Matt Hougan, long-term holders of Bitcoin are now less likely to sell their positions, which results in a shortage of the cryptocurrency that drives up prices.

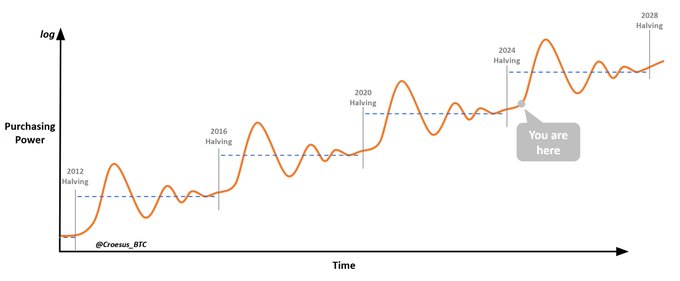

The halving of the bitcoin supply that took place after 2024, which resulted in a reduction in the number of new bitcoins entering the market, has exacerbated the scarcity impact. Industry analysts believe that each cycle of halves has the potential to trigger a supply shock, a phenomenon they observed in previous bull markets following halvings in 2020, 2016, and 2012.

An analyst for Bitcoin named Jesse Myers observed that “there is not enough supply available at current prices to satisfy demand,” which led him to speculate that the recent price increases would continue because demand is higher than the supply that is now available.

The introduction of Exchange-Traded Funds (ETFs) for Bitcoin has further fueled the boom. This is because institutional investors are increasingly allocating resources to Bitcoin. The total spot trading volume for Bitcoin exchange-traded funds (ETFs) surpassed $6.9 billion on November 11, indicating increased interest from institutional investors.

The introduction of Bitcoin exchange-traded funds (ETFs) has drawn investors to the market by providing a regulated investment channel. In addition, Polymarket, a well-known prediction site, demonstrated a significant rise in the number of wagers placed on Bitcoin, which reached $100,000 before the end of the year.

As of the 11th of November, the probability of Bitcoin surpassing this threshold had reached 57%, and the total trade volume on this prediction had surpassed $2.6 million. Positive conditions in the macroeconomic environment are also driving the current rally in Bitcoin.

Bitwise CIO Stance On Macroeconomic Factors

Considering that central banks, such as the Federal Reserve and the European Central Bank, have indicated that they may reduce interest rates in the future, the market anticipates an atmosphere that is more inflationary.

According to Bitwise CIO, Matt Hougan, “global rate cuts” and “economic stimulus in China” are contributing factors that are creating encouraging conditions for the price surge of Bitcoin. Additionally, the victory of Donald Trump in the US presidential election has instilled optimism among Bitcoin supporters.

The surge has been fueled by speculation about a Bitcoin-friendly government. Other notable individuals, such as Max Keiser, who serves as a senior Bitcoin advisor to the government of El Salvador, have expressed their belief that the current geopolitical atmosphere may be advantageous to Bitcoin even more.

Keiser gave the impression that a number of Middle Eastern nations, and possibly the Trump campaign, would be contemplating making significant Bitcoin purchases; however, these assertions are still considered contingent. Despite facing criticism earlier today, President Trump has made the promise of the Bitcoin Reserve to the cryptocurrency world.

Market Sentiment Shifts Toward Higher Price Expectations

The mindset among investors and analysts appears to be turning toward higher price estimates as the price of Bitcoin continues to rise. Tyler Winklevoss, co-founder of Gemini, observed that the recent rise of Bitcoin “gives a glimpse” into potential future growth, thus linking it to broader economic trends.

Willy Woo, a cryptocurrency analyst, pointed out that the amount of money streaming into the Bitcoin network has reached an average of $1.7 billion each day, which indicates that there is a lot of buying activity.

Data from Santiment shows a spike in transactions aimed at capturing gains, indicating that the swift price surge has prompted some investors to take profits. Despite this, the majority of investors continue to invest, suggesting their optimism about future returns.

The Chief Information Officer of Bitwise, Matt Hougan, along with other industry experts, is of the opinion that the present trajectory of Bitcoin might pave the way for a valuation in the six-figure range and, potentially, a road to one million dollars per Bitcoin in the longer future.