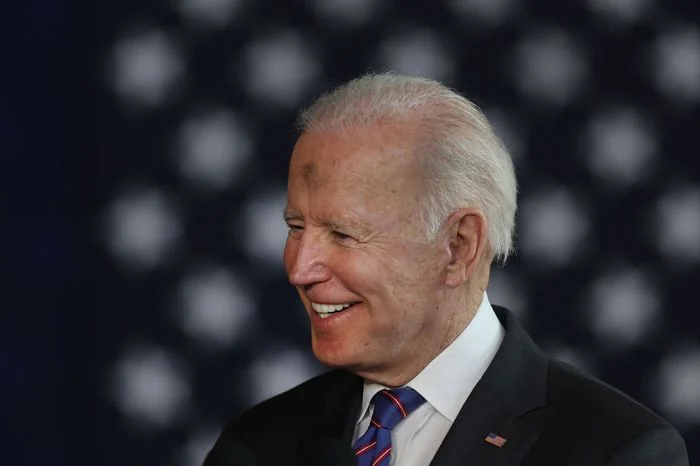

President Joe Biden’s budget released on Monday would modernize tax rules for digital assets, fight crypto misuse

Biden’s budget aims to raise $11 billion from digital asset traders

President Joe Biden’s budget proposal to “modernize” tax regulations for digital assets was announced Monday, and the administration expects the revisions to be part of a new revenue-raising initiative that will cut the federal budget deficit by more than $1 trillion over the next ten years.

The budget proposes revisions to tax rules that would force financial institutions and digital asset brokers to submit more information on their customers to the IRS and enhance reporting obligations for certain taxpayers who own international cryptocurrency accounts.

The study also advises adjustments to the law for full-time dealers or traders of cryptocurrencies such as bitcoin BTCUSD, +3.07 percent or ether ETHUSD, +4.14 percent, with total expected revenue of $11 billion raised between 2023 and 2032.

Biden Budget aims to fight crypto misuse

The Biden administration also wants to spend an additional $52 million on cyber-threats, the most dangerous of which being ransomware.

According to the budget document, the money would be used to hire more FBI agents and to improve “reaction capabilities and analysis skills.”

The budget states, “These efforts are in keeping with the administration’s counter-ransomware strategy, which stresses disruptive action and preventing bitcoin misuse.”

Changes to bitcoin tax regulations are likely to be contentious, given congressional disagreements over whether digital assets provide more benefits or threats to the US economy and consumers.

The newly passed bipartisan infrastructure plan is expected to raise $28 billion over ten years by imposing stricter reporting requirements, which the IRS believes will enable it to collect more of the taxes that Americans already owe.

The proposal was defeated, but a developing crypto lobbying ecosystem has committed to working with the Biden Treasury Department to ensure that it is implemented in a way that does not impose unnecessary restrictions on the crypto industry.