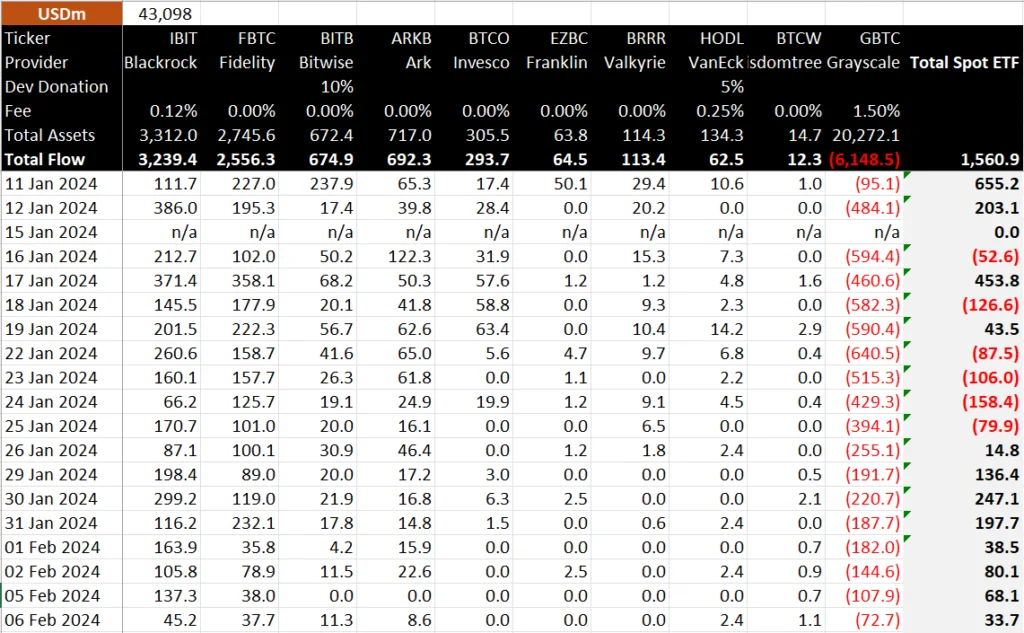

BlackRock Bitcoin ETF inflows decelerated to $45.2 million on Tuesday, compared to $33 million in net inflows for spot Bitcoin ETFs.

BitMEX Research reports that, as of Tuesday, inflows into most of spot Bitcoin ETFs plummeted due to dwindling liquidity and demand.

Grayscale Bitcoin Trust (GBTC) spot Bitcoin ETF outflow has, intriguingly, reached an all-time low.

Spot Bitcoin ETFs Net Inflows Slows to $33 Million

BitMEX Research disclosed on February 7 in its most recent spot Bitcoin ETFs inflow report that the aggregate inflows for 10 Bitcoin ETFs had decreased to $33.7 million.

Despite experiencing numerous net outflows, this represents the second-lowest inflow among 10 spot Bitcoin ETFs, following January 26’s inflow of $14.8 million.

BlackRock Bitcoin ETF (IBIT) inflows have fallen to an all-time low of $45.2 million.

Meanwhile, the previous day, BlackRock Bitcoin ETF received a $137.3 inflow, which sparked speculation regarding the ETF’s future demand.

Additionally, Fidelity’s FBTC experienced a $37.7 million decline in inflow.

Inflows to Bitcoin ETFs managed by Bitwise, Ark 21 Shares, VanEck, and WisdomTree increased by $11.3, $8.6, $2.4, and $1.1, respectively.

Eric Balchunas, Bloomberg senior ETF analyst, stated that every Bitcoin ETF that is currently underperforming has the capacity to improve in the future.

Grayscale Outflow Decelerates

Grayscale’s GBTC outflows have decelerated to a record low of $72.7 million since the U.S. SEC approved the spot Bitcoin ETF on January 11.

GBTC experienced a discharge of $107.9 million on Monday, February 5.

However, the decrease in GBTC outflows signifies a forthcoming cessation of the widespread withdrawal from the Bitcoin ETF.

Prominent analysts anticipate that it will have a favorable impact on the crypto market and the price of Bitcoin.

Meanwhile, GBTC is the category leader in liquidity.

Grayscale will need to establish a robust derivatives ecosystem around the underlying ETF if it wishes to maintain its leadership position and charge high fees.

For its spot Bitcoin ETF, GBTC is currently charging a management fee of 1.5%.

CME Surpasses Binance Once Again

Open interest (OI) for Bitcoin Futures on CME has once again surpassed that of Binance.

For just two days, crypto exchange Binance surpassed CME to become the dominant Bitcoin futures exchange.

CME reclaims its position as the leading Bitcoin futures exchange with a notional open interest (OI) of 106,090 BTC, valued at $4.55 billion, following a nearly 5% increase in Bitcoin futures open interest.

Second in terms of notional open interest is Binance, which has 103,660 at a value of $4.46 billion.