The notes carry an 8.5% annual interest rate, and Bitdeer plans to use the proceeds for business expansion and general corporate purposes.

Bitdeer Technologies Group, a cryptocurrency mining company based in Singapore, has announced that it intends to expand its data center and create ASIC-based mining rigs through a proposed public offering of convertible notes with a total value of $150 million and a due date of 2029.

On August 15, Bitdeer announced that the notes would be senior, unsecured company obligations. Unless converted, redeemed, or repurchased earlier, the notes will mature on August 15, 2029.

A senior convertible note is one type of financial security that has the potential to convert into equity at a later time. Besides serving as a type of debt for the company, investors may receive interest payments over time.

A corporation prioritizes a senior convertible note over all other debt instruments when it comes to debt securities. They permits the holders of the notes to convert them on the second scheduled trading day immediately following the maturity date.

Bitdeer offers Class A ordinary shares on maturity

Bitdeer will pay holders with Class A ordinary shares or a combination of cash and Class A ordinary shares upon conversion of the notes. This will happen at the time of the transformation.

On August 16, the cryptocurrency mining firm announced that the notes would be subject to an 8.5% annual interest rate. They stated that it would use the raised cash from the offering to further develop and expand its business.

Bitdeer said that the firm plans to use the net proceeds from the offering for a variety of objectives, including the growth of its data center, the creation of an ASIC-based mining rig, and the provision of working cash and serving other general corporate functions.

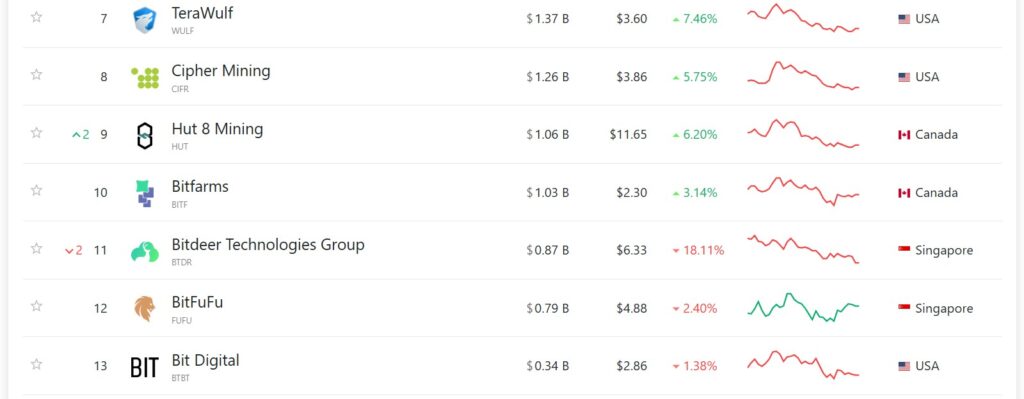

Bitdeer Technologies is the world’s eleventh largest cryptocurrency mining firm, according to market capitalization rankings. According to statistics provided by CompaniesMarketCap, the firm’s trade price is approximately $870 million, placing it ahead of competitors such as BitFufu and Bit Digital.

The stock price of Bitdeer plunged by more than 18% after the company made the announcement that it would be selling convertible notes, according to data from Google Finance.

The company’s 5-day chart shows a significant 23% price dump, with the price dropping from $8.26 on August 9 to $6.33 at the time of writing. Bitdeer is not the only mining company to see a decline in its stock price following the announcement of a convertible note issuance, as other companies have.

The stock prices of Core Scientific, a company that mines Bitcoin, dropped by ten percent on August 14, following the announcement of a senior convertible note offering worth four hundred million dollars.