Circle’s strategic initiatives include its planned IPO and move to Wall Street by 2025, positioning USDC as a regulated digital dollar alternative.

Circle, the company that issues stablecoins, has increased the fees that are required to redeem its USD Coin for the second time in a period of less than a year.

Bloomberg published a report on October 29 stating that the corporation has been collecting fees on daily redemptions totaling at least $2 million since September. Circle implemented swap fees in February for redemptions using the Circle Mint platform that were greater than $15 million.

Circle Raises USDC Cash-out Fee

The new costs, which begin at 0.03% per transaction and increase to 0.1% for withdrawals exceeding $15 million, primarily affect institutional investors and high-volume traders. A number of anonymous sources claim that the modification is an attempt to address the growing demand for liquidity that has arisen as a result of an increasing number of institutions utilizing digital assets.

It is still possible for traders to redeem USDC without incurring any fees, provided that they are willing to wait for the cash transfer for up to two days. Circle is determined to move forward with its ambitions for an initial public offering (IPO) and is planning to relocate its headquarters to Wall Street by the year 2025.

This decision comes as the market for stablecoins is becoming increasingly competitive. With the clearance of the United States Securities and Exchange Commission (SEC), the company submitted its initial public offering (IPO) application in January.

As part of its strategy to establish the USDC as a regulated alternative to the digital US dollar, Circle is working to expand its presence in international markets. In September, the company announced the integration of its stablecoin with the national banking systems of Brazil and Mexico.

This integration will allow businesses in these countries to gain access to USDC in real time through the financial institutions that are located in their respective nations. Despite the initiatives, US officials’ crackdown on cryptocurrency companies following the collapse of FTX has resulted in a drop in Circle’s market share over the past two years.

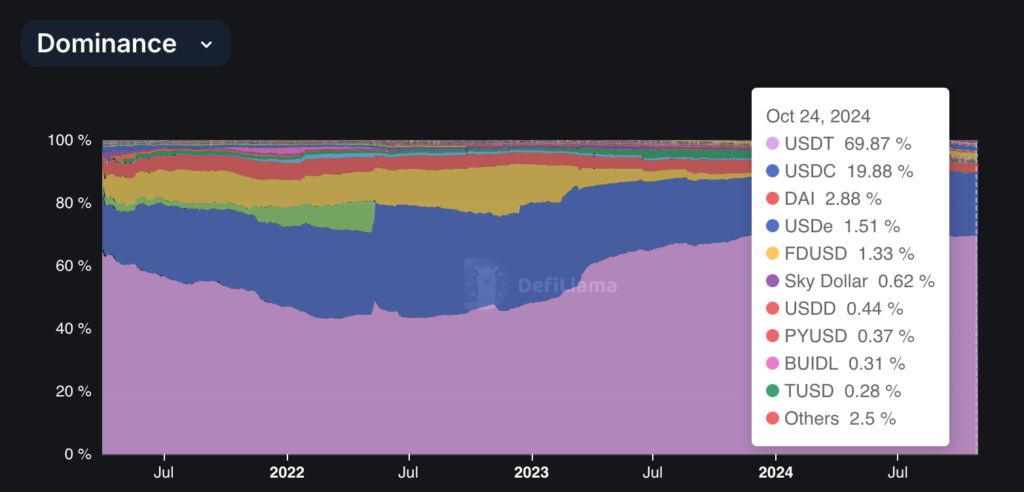

DefiLlama’s information indicates that USDC currently holds a total market share of less than 20% and a market valuation of $34 billion. In the meantime, its most significant rival, Tether, has a market valuation of 120 billion dollars and a market share of about 70 percent.

Tether applies a 0.1% fee for minting or redemption of USDT transactions exceeding $100,000. The stablecoin market is also something that BlackRock and Robinhood are interested in.

In addition to the asset manager’s intention to utilize its tokenized fund token, BUIDL, as collateral for derivatives trading, the financial technology company is investigating the possibility of a stablecoin in accordance with the legislative framework of the European Union.