Coinbase accuses SEC of sidestepping legal precedent in appeal over staking program classification.

In its most recent assault against the United States Securities and Exchange Commission (SEC), Coinbase has relied extensively on case law and reached the uncommon conclusion that “the SEC attempts to circumvent the [Howey] test.”

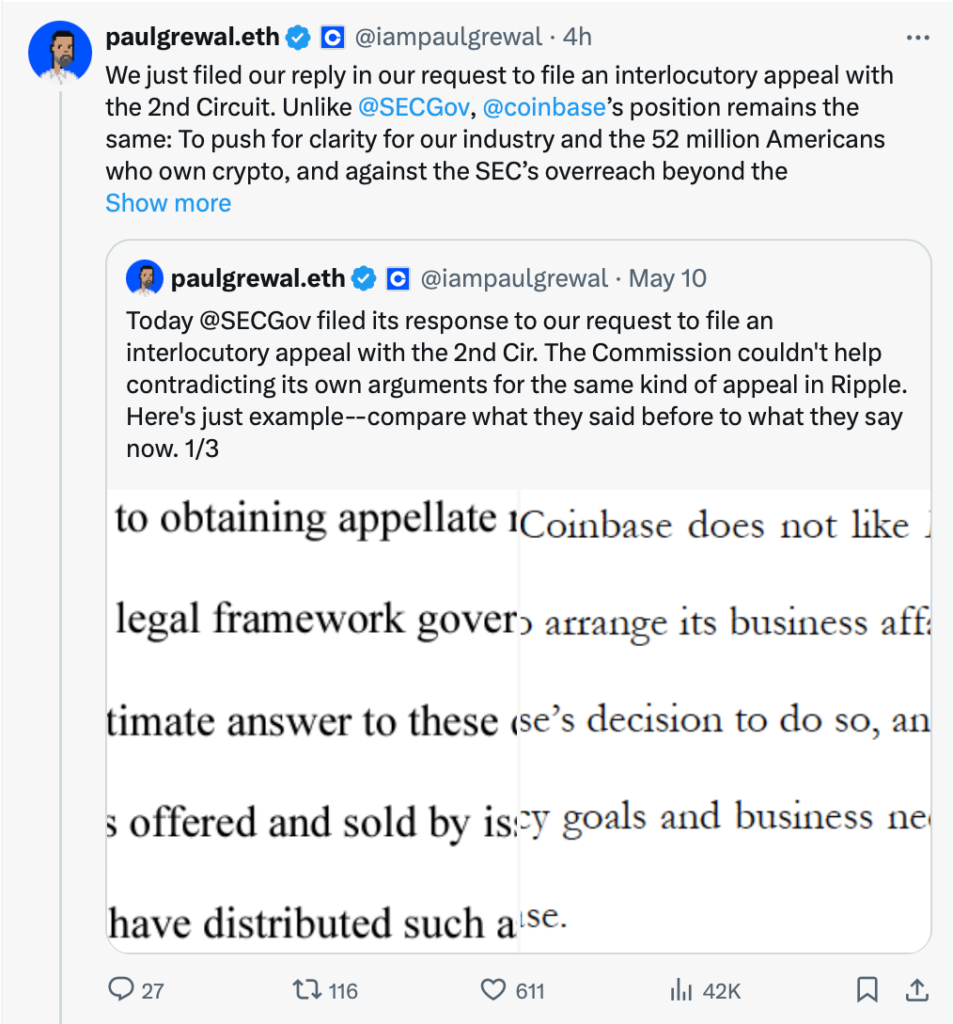

May 24 saw the submission of a memorandum by Coinbase in support of its interlocutory appeal, which is an appeal against a specific ruling in an ongoing case. This document serves as a rebuttal to the SEC’s rejection of its initial appeal request.

Coinbase lodged its interlocutory appeal on April 12, contesting a ruling from March 27 that deemed the SEC’s assertion that the cryptocurrency exchange’s staking program constituted an unregistered securities offering based on sufficient grounds.

Coinbase argued that whether an investment contract necessitates a contractual undertaking is the pivotal issue in the SEC suit—essentially the primary concern at stake and a prerequisite for an interlocutory appeal—and that this question drives the controlling argument.

The SEC contended in its memorandum opposing the initial interlocutory appeal filed by Coinbase that no court had previously required a contractual undertaking following the sale in order to apply Howey. In its counterclaim dated May 24, Coinbase stated:

“The SEC ignores that no appellate court in the 78 years since [the Supreme Court ruling that established the] Howey [test] has found an investment contract absent a post-sale contractual undertaking.”

As a result, the matter becomes suitable for a judicial resolution rather than “the inevitable application of settled law,” according to Coinbase.

Furthermore, it recognized that the assertions made by the SEC in its lawsuit against Ripple were incongruous with those made in Coinbase’s case, and it added that a measure had been passed by the House of Representatives mere days prior “that would deny the SEC the expansive jurisdiction it claims.”

In June 2023, the SEC initiated legal proceedings against Coinbase, charging the company with infringements of securities law. In addition to asserting the legitimacy of the staking program, the SEC certified thirteen cryptocurrencies on its list as securities.

Coinbase has demonstrated a commendable level of proactivity in safeguarding itself and the cryptocurrency sector. It launched the Stand with Crypto campaign in June, days after the SEC lawsuit was filed; the campaign now incorporates a political action committee.