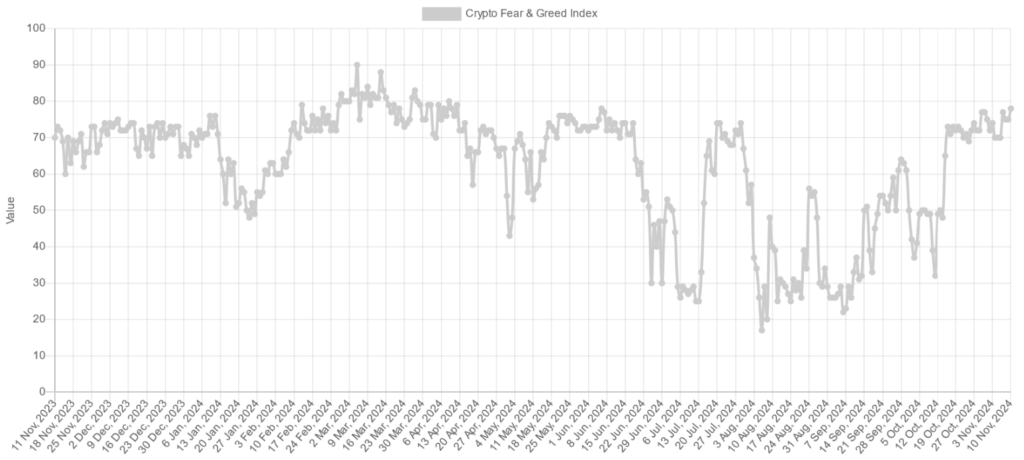

The Crypto Fear and Greed Index reached “Extreme Greed” with a score of 78, its highest since April, as Bitcoin surged past $81,000. This marks peak market optimism amid anticipation of the 2024 halving event.

Nov. 10 marked the highest level of “greed” in nearly seven months for the Crypto Fear and Greed Index, which gauges market sentiment for Bitcoin and other cryptocurrencies, as Bitcoin surpassed $81,000.

The index achieved a score of 78 out of 100, the highest it has been since April 12, when Bitcoin was trading at approximately $70,000 and the 2024 halving event was rapidly approaching. This score is in the “Extreme Greed” zone.

Bitcoin entered the “Extreme Greed” zone (75-100) on October 31 and has since fluctuated between 70 and 78 in the past week as Republican Donald Trump emerged victorious in the United States presidential poll.

According to CoinGecko, Bitcoin experienced a 6.15% increase to a new all-time peak of $81,358 on Nov. 10, but it has since declined to $80,182 at the time of writing.

On November 11, the Crypto Fear and Greed Index score has also marginally regressed to 76 out of 100.

Nevertheless, Bitcoin is expected to experience a significant increase in value prior to Trump’s inauguration on January 20, 2025, according to industry analysts.

The index calculates an aggregate score by evaluating market volatility (25%), trading volume (25%), social media sentiment (15%), Bitcoin’s dominance (10%), and trends (10%). Surveys were previously included in the calculation (15%); however, they are currently suspended.

Bitcoin to gain Popularity on Google

In the interim, the considerable increase in Google search interest for “Bitcoin” over the past week appears to have roused a greater number of retail investors in response to Bitcoin’s recent price surge.

Nevertheless, the current search interest for Bitcoin is still a far cry from the last bull run, with a score of 48 out of 100 in comparison to the peak of all-time search volumes in late May 2021, as per Google Trends data.

The victory of Donald Trump and the increased representation of pro-crypto legislators in the US Senate and House of Representatives for the 2025-2029 term have contributed to the bullish sentiment.

Should Trump fulfill his pledge to remove Gary Gensler as the SEC’s Chair, market participants may also benefit from a Securities and Exchange Commission that is potentially more accommodating.

According to crypto attorney Jake Chervinsky, Mark Uyeda, an SEC commissioner who has expressed dissatisfaction with the SEC’s enforcement regime and regulation, may be the next candidate to succeed Gensler.