The Russia-Ukraine war has resulted in the loss of about $200 Billion by crypto markets according to Market Watch.

Following the intensified conflict between Russia and Ukraine, Bitcoin nosedived again on February 23rd, resulting in a low of nearly $34k. Bitcoin wasn’t the only coin to suffer from this drop; the majority of altcoins lost even more, with large double-digit losses among the biggest altcoins.

Bitcoin plummets once more

The rapidly growing tension between Russia and Ukraine has drawn the attention of the entire world. Following weeks of threats and ostensible military drills, the world’s largest country by landmass did what many predicted and launched an invasion, which is still being referred to as a “special military operation.”

While reports show Russian troops and military vehicles crossing the Belarusian border into Ukraine, most stock markets have plummeted.

Russian markets have taken the brunt of the losses, but their equivalents in Asia and Europe have also suffered losses. The main US stock market index futures contracts have also turned bearish.

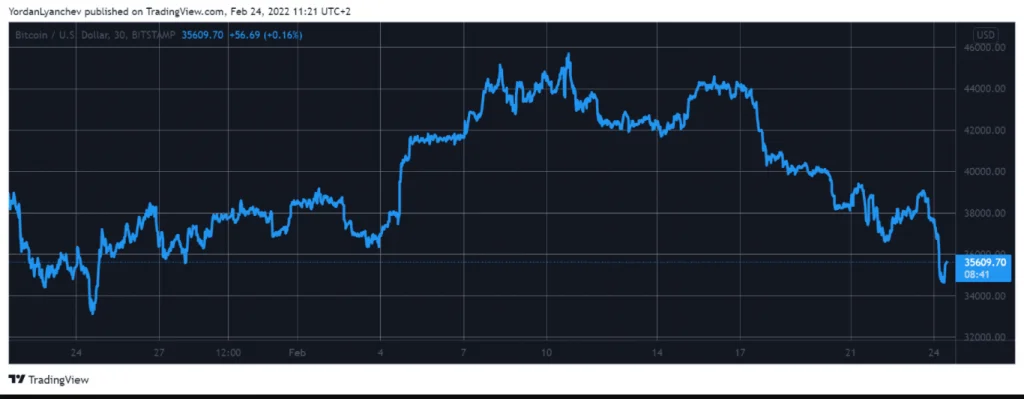

Given bitcoin’s recent high correlation with the aforementioned, it’s no wonder that the asset has fallen in value as well. BTC has dropped from a high of around $39,000 yesterday to a low of just over $34,000, its lowest level since late January.

Despite gaining some ground since then and now trading at $35,500, Bitcoin’s market capitalization has fallen below $700 billion.

Altcoins are also in the red

When bitcoin falls, so do the altcoins, as is customary for altcoins. Their daily losses, however, are much more. Ethereum, for example, fell more than 12% in a single day and is presently trading below $2,400. Furthermore, the second-largest cryptocurrency fell below $2,200 earlier today.

Binance Coin has fallen by a similar proportion and is currently trading around $340. Ripple and Avalanche have dropped between 12% and 14%, while Solana and Terra have dropped by 8%.

Cardano is one of the most significant daily losers, with a 17% price drop. Polkadot (-16%), Dogecoin (-16%), Shiba Inu (-15%), CRO (-15%), and MATIC (-16%) are the next coins.

Convex Finance (-23%), ECOMI (-20%), Kadena (-19 %), Curve DAO Token (-19%), Loopring (-19%), THETA Network (-19%), Enjin Coin (-19%), and many other companies suffer daily losses.

Since yesterday’s peak, the total market cap of all crypto assets has dropped by about $200 billion, falling below $1.6 trillion.