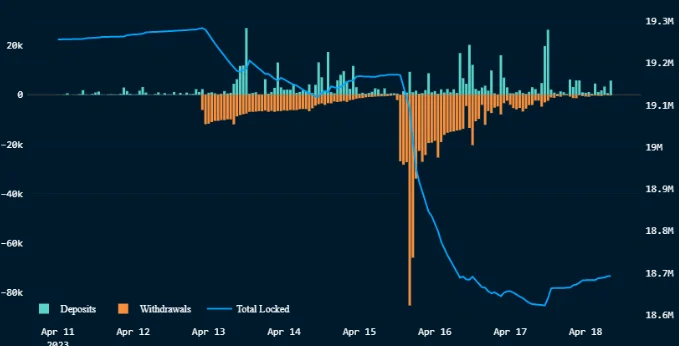

Since the Shapella Upgrade on April 12, the quantity of ETH staked has surpassed the number of ETH withdrawals for the first time. In the first week, more ETH was withdrawn than was staked.

According to data from on-chain analytics company Nansen, more ETH is being staked than withdrawn. On April 17, the volume of 124,000 ETH staked surpassed the volume of 64,800 ETH withdrawn for the first time.

In the previous twenty-four hours, there were 94,968 ETH staked versus 27,068 ETH withdrawn. The first round consisted predominantly of partial Lido withdrawals and old validators. Approximately three days are required to enter the withdrawal line.

The Shapella upgrade was anticipated to be a make-or-break moment for the Ethereum blockchain, as millions of unlocked ETH posed a mass-selling risk. The preponderance of validators, however, is re-staking their unlocked Ether. Binance will begin accepting withdrawals on April 19.

Three addresses resold 19,844 ETH out of the 1,000,000 ETH withdrawn. After withdrawal, three addresses transferred ETH to centralized exchanges (CEXs), sending 71,444 ETH to various exchanges.

According to data from Lookonchain, other whales did the same, with some transmitting it to Huobi staking addresses and a few others to CEXs.

Most early withdrawals are staking rewards, and a few validators, such as Kraken, were required to exit to comply with a Securities and Exchange Commission ruling.

Currently, 22,231 validators out of 574,624 have signed up for a complete exit, and 910,930 ETH out of 18.6 million staked ETH will be withdrawn.

The price of ETH, which is approximately $2,137 on average for staked ETH, may also be a significant factor in the decline of withdrawals.