Ethereum futures look promising, but the question still remains whether people are ‘merely talking than doing’?

The Bitcoin vs. Gold debate has recently gained traction as a result of investors seeking safe-haven assets to diversify their portfolios. This is a major issue for some, especially given the overall rise in prices.

Federal Reserve Chair Jerome Powell recently stated that inflation may remain high for several months before declining. The Central Bank’s balance sheet is now worth $8.2 trillion, which is ten times what it was in 2008. So, in this type of environment, where are investors putting their money?

The Current State of the Futures Market

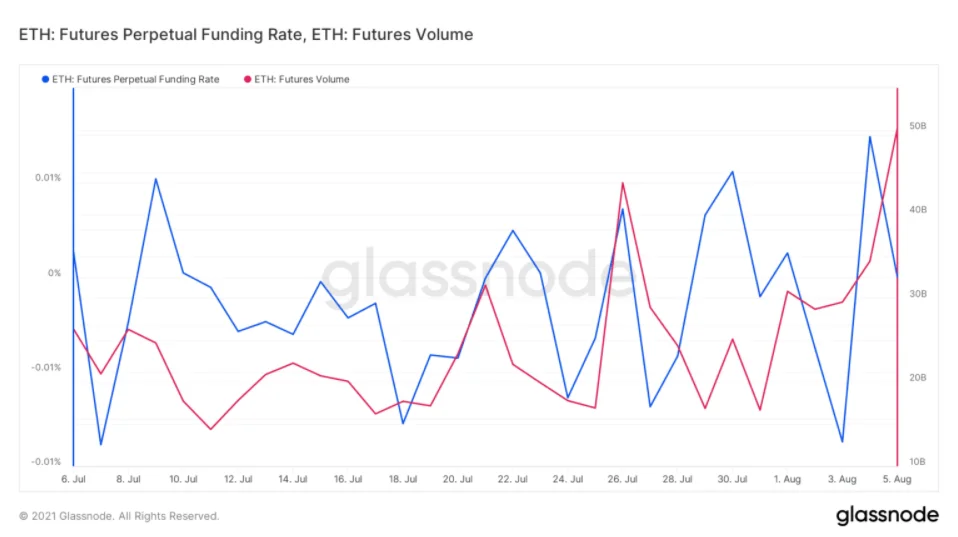

On August 4, the permanent financing rate for Ethereum Futures reached a one-month high. A high positive financing rate indicates that the cost of a permanent contract is more than the Mark price. As a result, long traders pay for short positions.

Despite small adjustments on the four-hour chart for Ethereum, futures volume was higher at the time of publication. This, once again, indicates that people are most likely hedging for the market.

The Bitcoin vs. Gold debate has recently gained traction as a result of investors seeking safe-haven assets to diversify their portfolios. This is a major issue for some, especially given the overall rise in prices.

Federal Reserve Chair Jerome Powell recently stated that inflation may remain high for several months before declining. The Central Bank’s balance sheet is now worth $8.2 trillion, which is ten times what it was in 2008. So, in this type of environment, where are investors putting their money?

The Current State of the Futures Market

On August 4, the permanent financing rate for Ethereum Futures reached a one-month high. A high positive financing rate indicates that the cost of a permanent contract is more than the Mark price. As a result, long traders pay for short positions.

Despite small adjustments on the four-hour chart for ETH, futures volume was higher at the time of publication. This, once again, indicates that people are most likely hedging for the market.

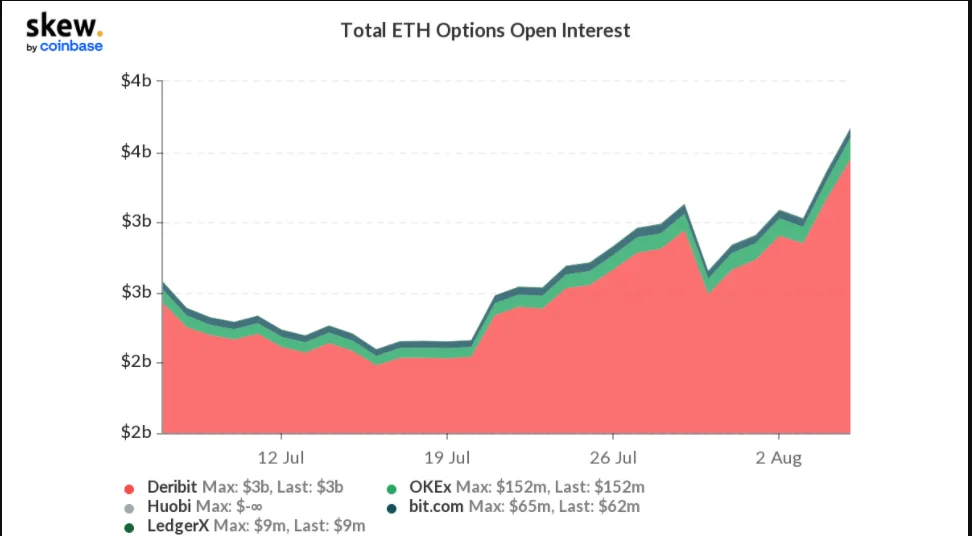

In addition, volumes on Binance alone have increased by about $6 billion in the last 24 hours. Other major exchanges saw similar high numbers. All exchanges’ open interest peaked as well.

High open interest indicates that many contracts are still open, indicating that market participants will be paying careful attention to the market.

Having said that, options volume implied that calls were outnumbering puts. As a result, more people appear to be anticipating a price increase rather than a price decrease.

The former was reflected by 9955 DBT hedging for Ethereum’s price to rise to $50,000 by March 2022 in the previous day alone.

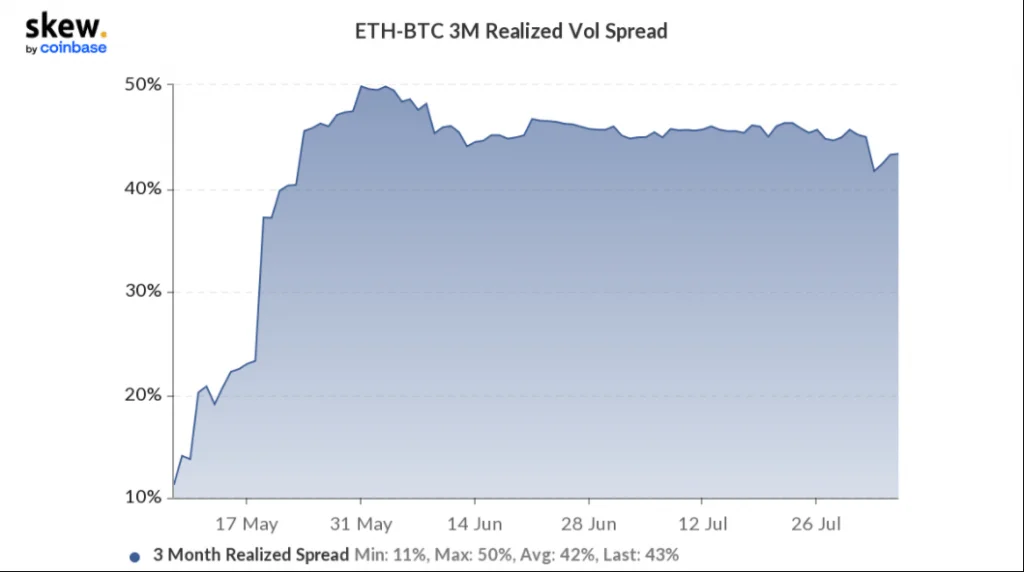

Even if the ETH/BTC realised volatility spread showed a slight increase on the three-month chart, it might be regarded significant due to the concurrent growth in BTC’s price. However, the rise in the same, as the metre read 43 percent at the time of writing, meant that ETH’s price was increasing in compared to BTC.

Is there a surprise in store?

While all of this appears to be positive on the surface, it is worth noting that a recent Santiment analysis highlighted how social sentiment and activity on the ETH network have been sending contradicting signals. With social sentiment and dominance at an all-time high while active addresses are at an all-time low, ‘the mob is more talking (social dominance) than doing (active addresses).’

In such a case, it is best to keep an eye on the market for a few days, as the market may surprise everyone. In any case, it appears that there is a lot of volatility, based on the bullish expectations in both the futures and spot markets.