In the most recent decentralized finance (DeFi) breach, Blockchain security firm PeckShield detected a hack that allowed the exploiter to mint over 1 quadrillion Yearn Tether (yUSDT).

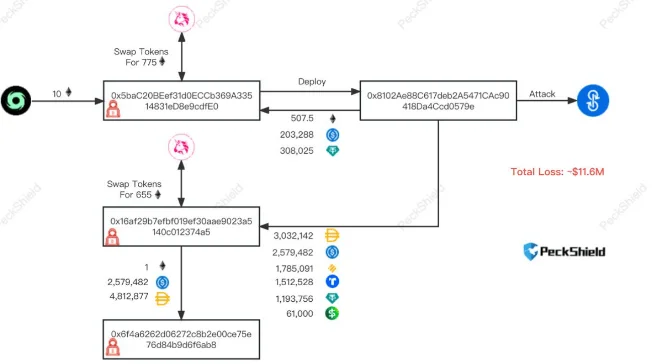

According to the security firm, the intruder then exchanged yUSDT for other stablecoins, allowing them to obtain stablecoins worth $11.6 million. This consists of 61,000 Pax Dollars (USDP), 1.5 million TrueUSD (TUSD), 1.79 million Binance Dollars (USD), 1.2 million Tether (USDT), 2.58 million USD Coin, and 3 million DAI.

According to PeckShield, the intruder has already transferred 1,000 Ether, worth approximately $2 million, to the authorized cryptocurrency mixer Tornado Cash. The blockchain security company also flagged the Aave and Yearn Finance DeFi protocols to inform them of the situation.

After preliminary investigations, the lending platform Yearn Finance announced that the problem was limited to iearn, an obsolete contract before Vaults V1 and V2. Current Yearn Finance contracts and protocols are not affected by the exploit, according to the DeFi protocol.

In the meantime, Aave stated that they are also aware of the transaction. Recently, the liquidity protocol affirmed that the hack had no effect on Aave V1, V2, or V3.

While hacks continue to plague the DeFi industry in 2023, the quantity of money lost due to hacks has decreased compared to prior years. More than $320 million were lost to breaches in the first quarter of 2023, according to the quarterly report of blockchain security firm CertiK.

The losses were significantly less than in the first quarter of 2022, when $1.3 billion was lost, and in the fourth quarter when $950 million was lost to breaches.