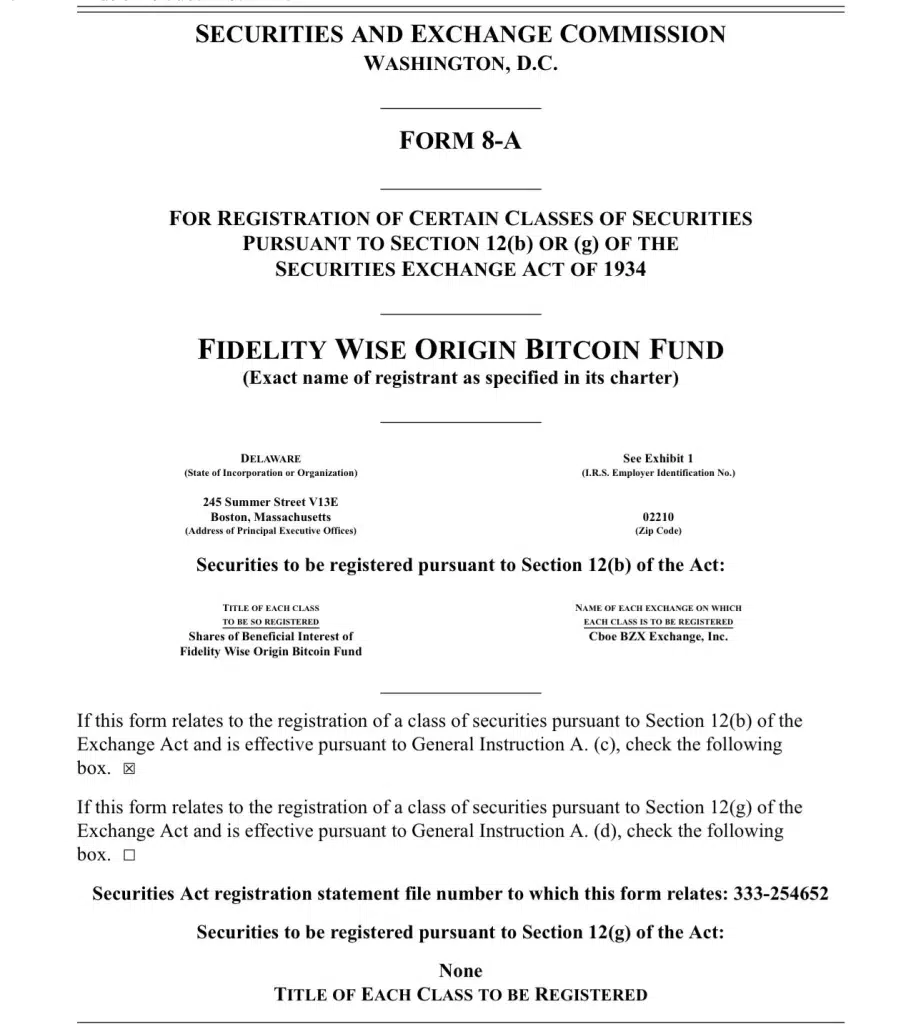

The company has registered its Fidelity Wise Origin Bitcoin Fund with the U.S. Securities and Exchange Commission (SEC) by filing Form 8-A, claiming over $4.5 trillion assets.

With this filing, Fidelity is taking a step toward becoming a publicly traded company, and it also signifies a wider acceptance of digital assets in conventional investing portfolios.

The petition coincides with a volatile moment in the cryptocurrency market. Matrixport’s prediction that the SEC would reject all ETF applications caused the market to lose nearly $540 million in liquidation today.

But soon after, several reporters and commentators disputed such assertions. A crucial regulatory prerequisite for businesses looking to list securities on an exchange is SEC Form 8-A.

The fact that Fidelity has registered this method demonstrates its adherence to regulatory requirements and opens the door for its spot Bitcoin exchange-traded fund (ETF) to be made available on a national securities exchange.

As indicated in the form, the listing on the CBOE BZX Exchange indicates that Fidelity is putting itself at the forefront of the ETF investment wave. This registration confirms the fund’s validity by placing Fidelity’s Bitcoin fund under the SEC’s regulations and supervision, which are intended to safeguard investors and uphold fair markets.