Franklin Templeton is the most recent Wall Street firm to apply to the SEC for a spot Ethereum exchange-traded fund (ETF) in the United States.

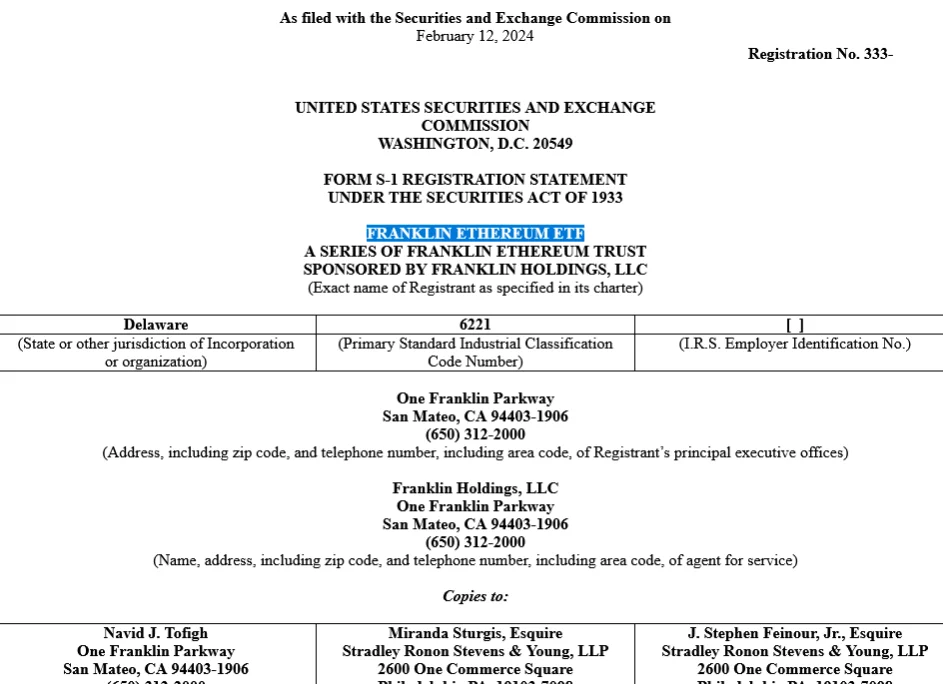

The organization, which manages assets worth $1.5 trillion, formally filed Form S-1 with the United States Securities and Exchange Commission (SEC) on February 12. It would be trading on the Chicago Board Options Exchange under the symbol “Franklin Ethereum ETF” if approved.

In an intriguing manner, Franklin signified its intent to stake a portion of the ETF’s Ether to generate additional income, mirroring the revised S-1 filing of ARK 21Shares from the previous week.

“The Sponsor may, from time to time, stake a portion of the Fund’s assets through one or more trusted staking providers, which may include an affiliate of the Sponsor.”

Franklin stated that it anticipated staking Ether from the cold storage accounts of the trust in exchange for staking rewards, which would be considered income for the trust.

Hashdex, BlackRock, VanEck, Fidelity, Invesco Galaxy, Grayscale, and VanEck are the remaining spot ETF applicants competing for approval from the SEC.

VanEck, ARK 21Shares, Hashdex, Grayscale, and Invesco are all due for SEC decisions by the specified dates, with May 23, June 18, and July 5, respectively, before the deadlines.

The decisions regarding the petitions of Fidelity and BlackRock are due on August 3 and August 7, respectively.

As an analogous process transpired on January 10, when the U.S. securities regulator rendered a verdict concerning all spot Bitcoin ETFs, Bloomberg ETF analyst James Seyffart anticipates a determination regarding all applicants by May 23.

On January 30, Seyffart’s colleague and fellow Bloomberg ETF analyst Eric Balchunas reduced the probability of a spot Ether ETF approval in 2024 from 70% to 60%.

Last month, Franklin Templeton was among the ten ETF issuers that introduced a spot Bitcoin ETF in the United States.

Although Franklin was a late entrant in the Ether ETF race, its recent acclaim for the network fundamentals of Solana, Ethereum, and other blockchains has prompted speculation that the ETF issuer may seek to broaden its operations beyond Bitcoin.