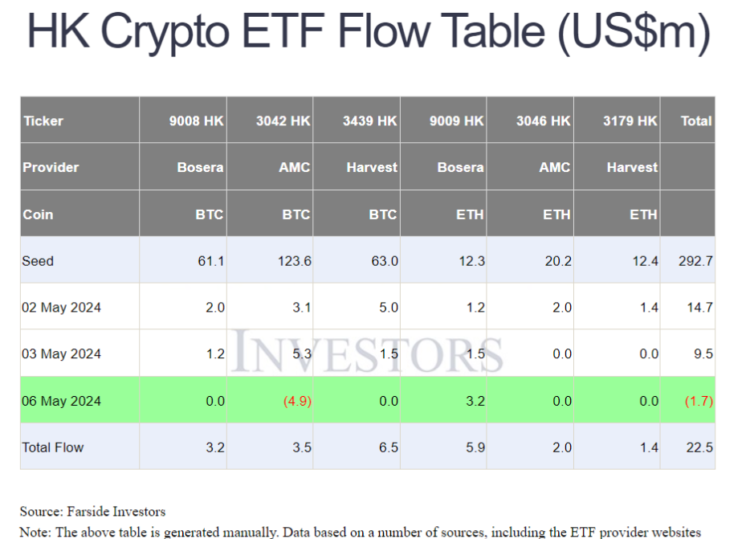

In their inaugural trading week, Hong Kong spot Bitcoin exchange-traded funds (ETFs) have significantly lagged behind their US counterparts, managing to attract around $22.5M in inflows.

A substantial portion of the $262 million in assets under management (AUM) that the three spot Bitcoin ETFs that debuted in the East Asian city on April 30 have amassed through subscriptions before their listing, according to data compiled by Farside Investors.

In contrast, during the initial week of operation, their asset inflows were below $14 million, significantly lower than the billions poured into US spot Bitcoin ETFs in January.

“Compared to the launch of US ETFs, the introduction of Bitcoin and Ethereum ETFs in Hong Kong is, in our opinion, a far less significant event,” Farside Investors stated. As of May 6, Hong Kong spotted Ether ETFs, the first of their kind globally, but they also failed to impress, amassing $54.2 million in AUM and $9.3 million in total inflows.

The Hong Kong spot crypto ETFs were believed to have substantial enhancements over their US counterparts. ETFs are denominated in three fiat currencies and facilitate in-kind transfers via Bitcoin or Ether, allowing investors to purchase and redeem units directly.

“[A]s we advised, don’t expect significant numbers in Hong Kong compared to the United States,” senior Bloomberg ETF analyst Eric Balchunas said of the outcomes. “[However] the Hong Kong ETFs’ $310 million is equivalent to $50 billion on the US market. “Thus, these ETFs are already as large about their local market as they are to their US market,” he continued.

The Hong Kong equity sector is comparatively modest in scale, boasting a total market capitalization of $4.5 trillion, in contrast to the $50 trillion worth of equities listed on all US exchanges. Additionally, the Hong Kong equity market has become considerably less liquid since 2022 due to sluggish economic expansion in mainland China.

Over eighty percent of crypto-savvy investors in Hong Kong intend to purchase the new spot Bitcoin and Ether ETFs, according to a recent study by the cryptocurrency exchange OSL. However, mainland Chinese investors can only access the assets if they hold Hong Kong residency.

Researchers at SoSoValue remarked, “Mainland Chinese RMB investors are prohibited from purchasing, and incremental funds may be restricted, resulting in a low volume of transactions.” They added:

“This Hong Kong cryptocurrency ETF still has strict restrictions on investor qualifications, and mainland investors cannot participate in transactions. Taking Futu Securities as an example, the account holder is required to be a non-resident of mainland China and the United States before trading can be conducted. The market expects mainland funds to be traded through southbound Hong Kong Stock Connect, which is currently not allowed and is expected to be difficult to open for a long time.”

In addition, SoSoValue researchers observed that, following an initial teaser fee period, the annual management fees of Hong Kong crypto ETFs range from 0.85% to 1.99%, which is significantly higher than the average yearly management fees levied by US issuers, which are 0.25%.

“The holding cost of the US Bitcoin ETF is lower for institutional investors who are optimistic about the cryptocurrency market and intend to hold it for an extended period due to the fee difference,” SoSoValue explained.