Bitcoin’s (BTC) sharp gain in the second half of March appeared to be winding down by Tuesday. However, a key indicator of retail interest suggests that the world’s largest cryptocurrency could see even bigger gains.

After gaining 17% in the last 30 days, the token was last trading at around $46,000. It’s presently around its highest level in 2022, but it’s still trading 31% below an all-time high of $46,784.

“Weak hands” could indicate strong BTC gains.

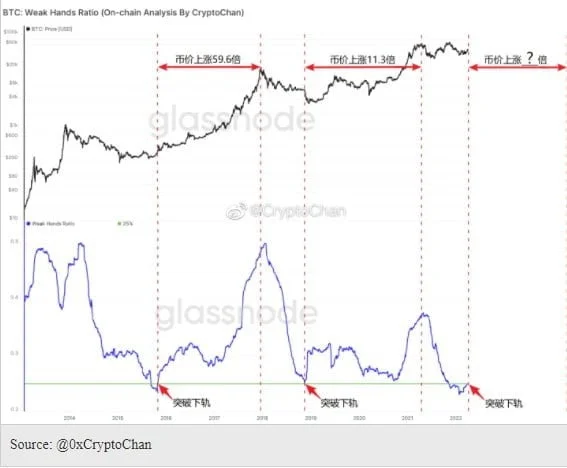

The ratio of BTC tokens that have remained unchanged on the chain to the total BTC circulation was drifting around record lows, according to Twitter commentator @0xCryptoChan. The ratio, also known as the paper hands or weak hands indicator, depicts the degree of retail interest in the market, which is currently at record lows of less than 25%.

But the ratio’s retaking of the 25% level has always signaled a significant surge in BTC. The last time this happened, BTC’s price soared 11.3 times between late 2019 to 2021. The time before that, BTC’s rate increased 59.6 times from early 2016 to 2018.

The paper hands ratio is currently set to break back above 25%, perhaps igniting another rise.

“Paper hands” refers to retail investors who are hesitant to trade due to their limited liquidity. Traders like this are usually the last to enter a bull run or depart a bear market. Given the rally in BTC in March, April could be the entry point into the next bull run for retail traders.

Without significant news in the cryptocurrency sector, BTC is again working as an indicator of global demand for risky assets. However, it will be possible to speak with confidence about the local victory of the bulls only after BTCUSD fixes above the 200-day moving average, which is now passing near $48300.

-Alex Kuptsikevich, senior financial analyst at FxPro

Institutions, the main drivers of BTC’s rally

The weak paper hands ratio also emphasizes an important aspect of Bitcoin trading which is that large trading houses account for the majority of its volumes. The trend picked up in 2021, and it was an important factor in BTC’s run to record highs.

More than 90% of BTC’s daily transactions have continuously exceeded $100,000 since 2020, indicating that the token is being traded on a big scale according to recent data.