The reputation system is aimed at retail investors in Europe and projects worldwide seeking regulatory clarity for crypto fundraising.

Legion, a crypto fundraising platform, has unveiled a new reputation system targeting retail investors and startups launching initial coin offerings (ICOs) under European Union regulations.

As per Legion, this system “simplifies things for teams” by allowing them to reach retail investors with early-stage offerings or token sales based on selected characteristics.

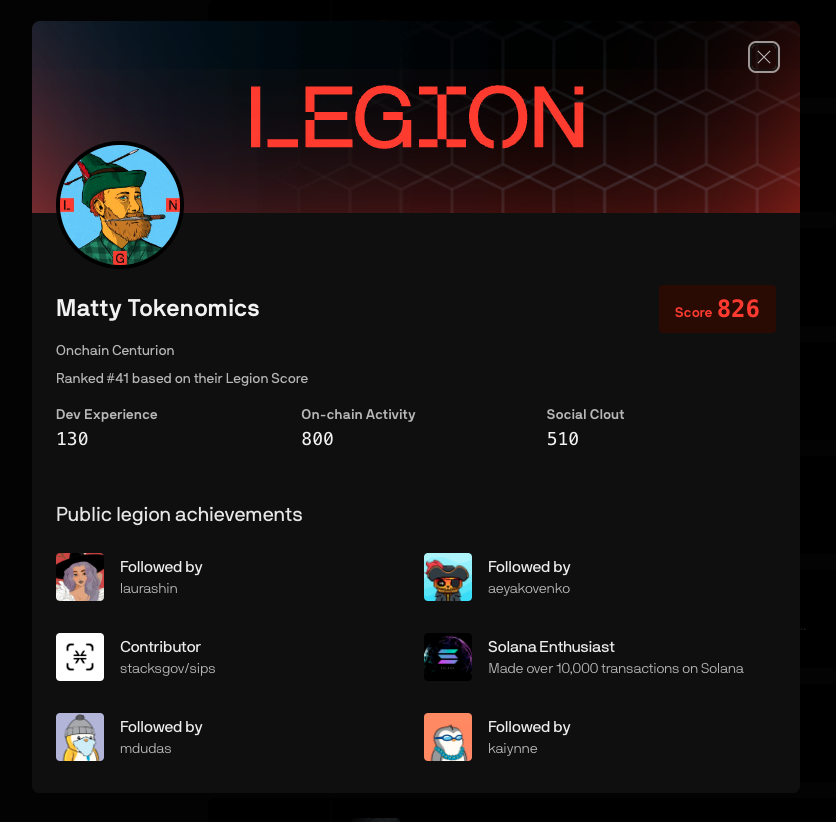

It evaluates investor behavior by analyzing factors like on-chain history, social influence, and developer activity, leveraging the EigenTrust algorithm—an open-source reputation model for peer-to-peer networks created by Stanford academics Sep Kamvar, Mario Schlosser, and Hector Garcia-Molina.

“Projects don’t want to sell tokens to bots, Sybils, and people who will do nothing for the project and just be a distraction in their Discord,” explained Matthew O’Connor, Legion’s co-founder, in an interview with Cointelegraph.

O’Connor further described the platform as an alternative crowdfunding option for startups, adding:

“Once the token is sent to the investor, there is no recourse for bad acting or investors breaking promises […] without some kind of investor reputation system, the best projects will simply continue to avoid selling tokens to anonymous wallets, and raise from VCs.”

This reputation framework seeks to replicate real-world trust relationships, with credibility flowing outward from “high-reputation people, like Vitalik Buterin, for instance, to people that Vitalik has worked with.

Then, the people that have worked with people Vitalik has worked with inherit some of their trust, and so on,” O’Connor clarified.

Legion’s vision is to become “the Airbnb of crypto fundraising,” matching high-reputation retail investors interested in Web3 projects with startups seeking support for their ventures.

According to O’Connor, retail investors represent “the segment that is currently underserved by existing options,” bringing unique value through detailed feedback, organic marketing, and community-building that “top VC’s can’t.”

ICOs under MiCA

The EU’s Markets in Crypto-Assets Regulation (MiCA) provides a comprehensive regulatory framework for ICOs across its member states.

While utility tokens under MiCA must meet transparency and disclosure requirements, they are not considered financial instruments.

Legion intends to operate within this regulatory structure, offering tokens to EU-based investors but limiting access for U.S. retail investors.

“We also abide by rules in the US like RegS and RegD, so non-accredited US investors can’t participate for now,” noted O’Connor.

Crypto startups using the platform do not need to be based within the EU. Legion plans to allow venture capital firms to participate in the future, though they will compete alongside retail investors, which O’Connor describes as “healthy competition that benefits everyone.”

Crypto startups raised $2 billion in venture capital in Q3 2024, bringing the total for the year to almost $8 billion, as reported by Crunchbase.