Only weeks ago, the digital art market seemed unable to refresh itself. The non-fungible token (NFT) was in full focus throughout February, and its mania reached its height at the record $69 million auction for Beeple. Even Elon Musk, CEO of Tesla, tweeted at her height to sell his NFT.

However, as the news started to wear and speculators moved on, the NFT market continued to decline. Digital art and collectibles sales across online markets have fallen sharply, potentially exposing the absence of organic demand in NFT spaces.

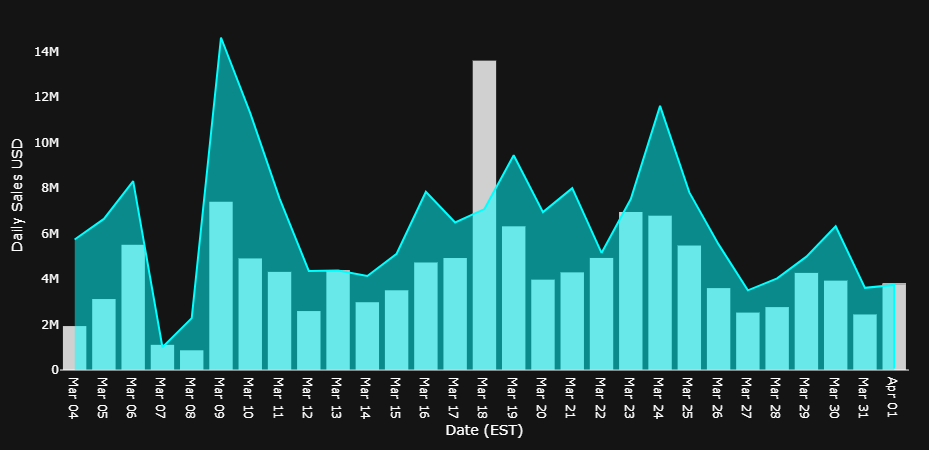

The average daily values of NFT sold throughout markets declined by around 85 percent, based on figures from NonFungible, from $19 million to $3 million on 25 March. Other important measurements have shown disturbing signs.

The overall sales and unique purchasers decreased by 30% and 35 in the last week alone. Those figures left speculators and market players wondering if the NFT is temporarily sweeping, or if it was merely a flash in the pot.

DESPITE WORRYING INDICATORS, NFT MARKETPLACE NBA TOP SHOT SHOWS SIGNS OF STRENGTH

The total value of NFTs in circulation (which represent total market capitalization) has dropped $800 million — down from a $1.85 billion top to $1 billion — was shown by NBA Top Shot, an NFT marketplace of NFT trading cards. The.market assessment shows a similar decrease in overall sales value as demand on the secondary market dropped.

But what is interesting is that demand in the primary market remains relatively healthy. New Top Shot releases continue nearly instantly to be sold. In view of this, the speculative frenzy for NFTs probably overheated the market — leading to a temporary pullback.

This also appears to be a common feeling among risk capitalists. Dapper Labs, NBA Top Shot’s parent company, has recently raised funding of $305 million – not a paltry amount. Other NFT markets such as OpenSea have funded their businesses, in spite of the recent pullback. This is clearly a sign of investors’ confidence, as they have bets on the NFT industry’s long-term sustainability and growth.

In the broader cryptoecosystem, non-fermentable tokens will most likely continue to exist. However, it remains to be seen whether it will soon surpass its recent peaks.