Following a $3.8 million attack on a well-known security vulnerability, Onyx intends to relaunch its governance-focused financial network with full community support.

After suffering a $3.8 million loss in a hack on September 27, which exploited a known but unaddressed security vulnerability, decentralized finance (DeFi) protocol Onyx gained community approval to relaunch its open-source, permissioned financial network, Onyx Core, as a key product aimed at improving governance.

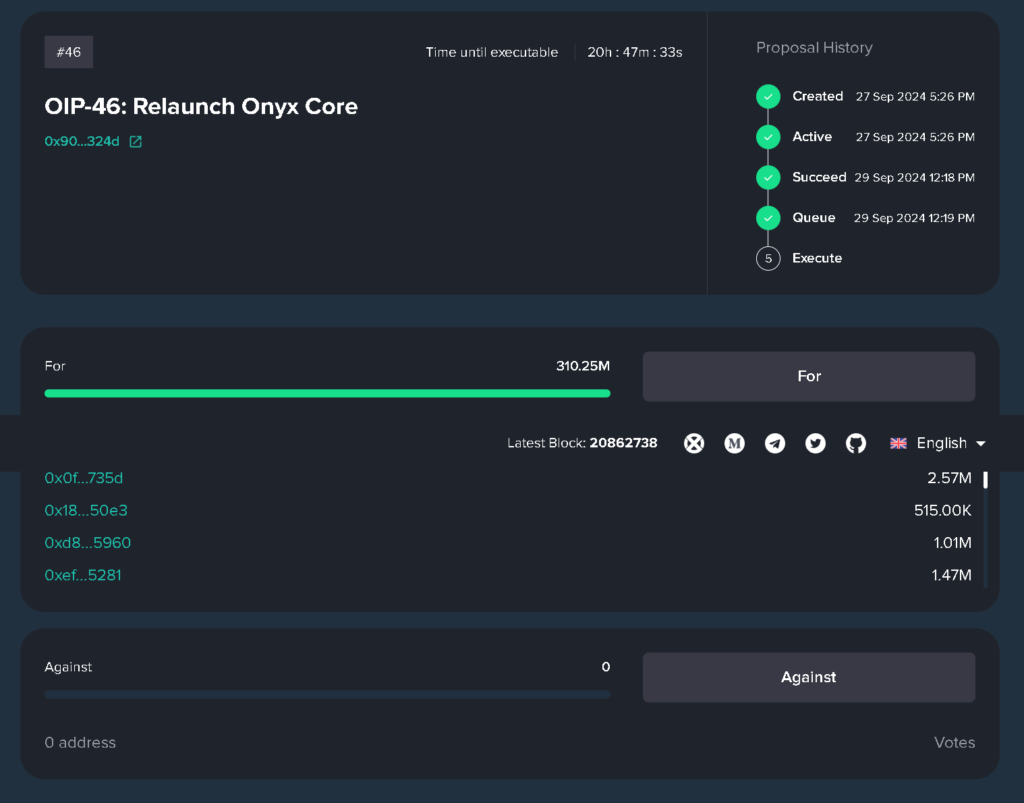

The Onyx Improvement Proposal “(OIP)-46: Relaunch Onyx Core” was introduced shortly after the $3.8 million exploit.

The proposal called for significant changes to the protocol and its product offerings, including the shutdown of its Ethereum-based lending market and a commitment to fully reimburse lenders with “a 1:1 payment of the assets they supplied.”

By September 29, the OIP-46 proposal had received unanimous support from Onyx community members, with no opposition to the suggested changes.

The proposal is scheduled for execution on October 1. The Onyx team will also release a revised white paper for Onyx Core’s relaunch as a primary product, alongside staking for Onyxcoin (XCN).

Onyx Reassesses Core Business Offerings

The restructuring will see Onyx Protocol operate as a closed-ended lending protocol on Onyx Core, allowing users to wrap non-fungible tokens (NFTs), real-world assets (RWAs), and crypto assets.

In the September attack, the hacker manipulated an NFTLiquidation contract to inflate the self-liquidation reward artificially.

According to blockchain security firm PeckShield, the same vulnerability was used in an attack on Onyx in October 2023.

Similar hacks, such as the Hundred Finance exploit in April 2023, also targeted this vulnerability. The proposed changes aim to secure Onyx Protocol from future attacks.

Crypto Hackers Favor Centralized Exchanges

Web3 cybersecurity firm Cyvers reported that losses from crypto hacks in the first three quarters of 2024 surpassed $2.1 billion.

Centralized finance operators, particularly crypto exchanges, were the most targeted, seeing a 984% year-on-year increase in the first three quarters of 2024.

A significant portion of these losses occurred in the second quarter, totaling $401 million.

While losses in the DeFi sector decreased by 25% year-on-year in Q2, the sector still experienced $171.3 million in losses across 62 incidents.