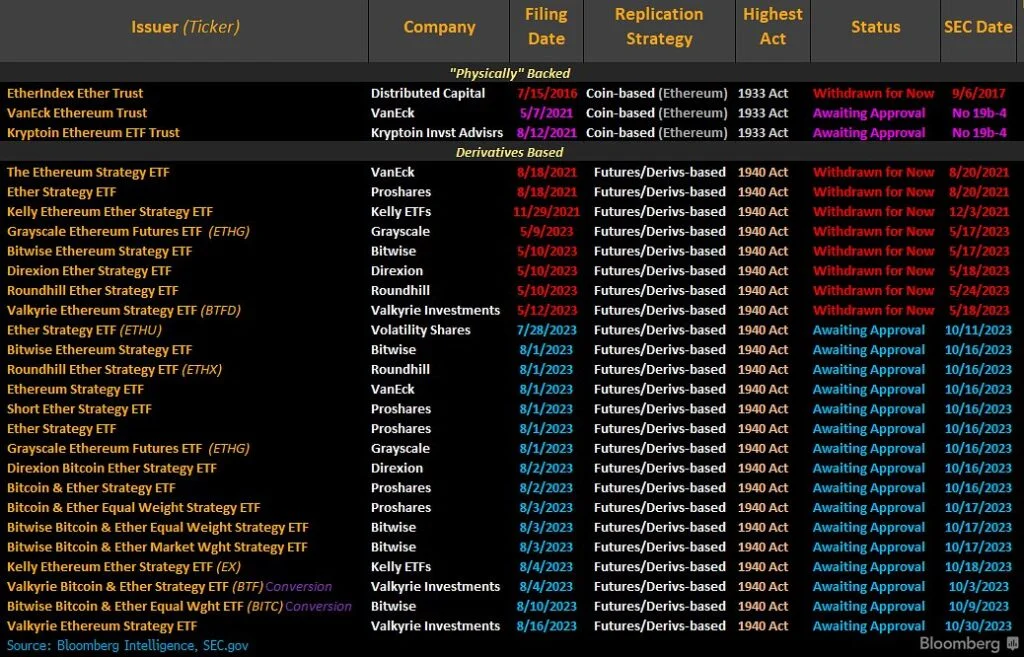

Bloomberg reports that the US SEC is set to sanction an Ethereum Futures ETF as the crypto community awaits a Bitcoin ETF.

Bloomberg reports that the US SEC is set to sanction an Ethereum Futures ETF as the crypto community awaits a Bitcoin ETF. Valkyrie is anticipated to list the first Ether Futures ETF on October 3rd or 4th.

The First Ethereum Futures ETF to Launch in October

Today, the US SEC has signaled that it will permit the first crypto futures ETF based on Ethereum, the second-largest cryptocurrency in the world. According to Bloomberg, it is unlikely that the SEC will prevent the October distribution of products based on Ether Futures. Multiple companies, including ProShares, Volatility shares, Bitwise, and Roundhill, have also submitted applications for ETFs based on Ethereum.

An Ether Futures ETF will enable investors to gain exposure to Ethereum through stock exchanges, similar to how Apple or Tesla stocks provide direction to the underlying asset. The current market capitalization of Ether is $192 billion, which is expected to increase significantly once a futures ETF is approved.

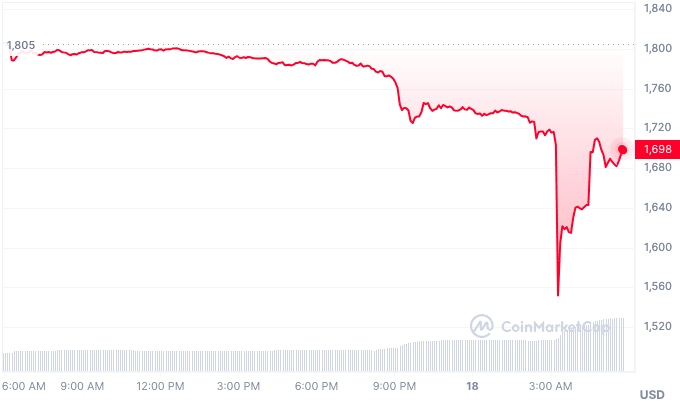

The Crash of Crypto Market; Ethereum Price Recovery

Earlier today, news of SpaceX’s Bitcoin sale precipitated a market-wide Bitcoin price decline of more than 10%. The Bitcoin price quickly recovered and is currently trading at $26,774, while the Ethereum price is trading at $1695 after briefly falling to $1550.